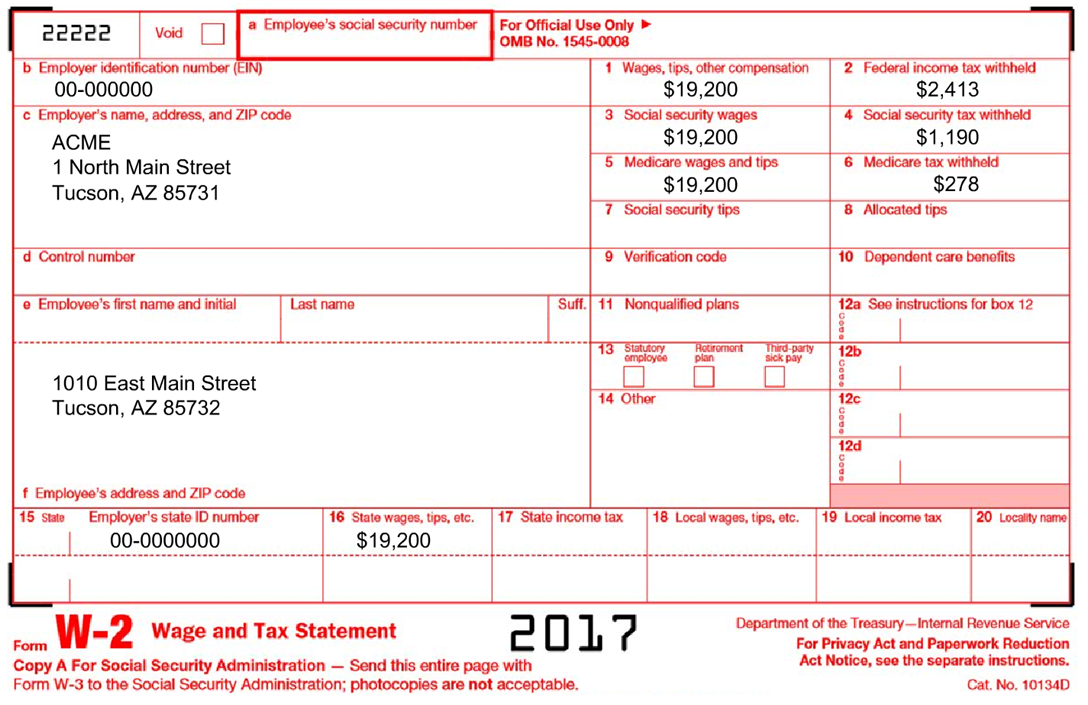

Juan Garcia is single and lives at home with his parents and CAN be claimed as a dependent. He has no combat service and

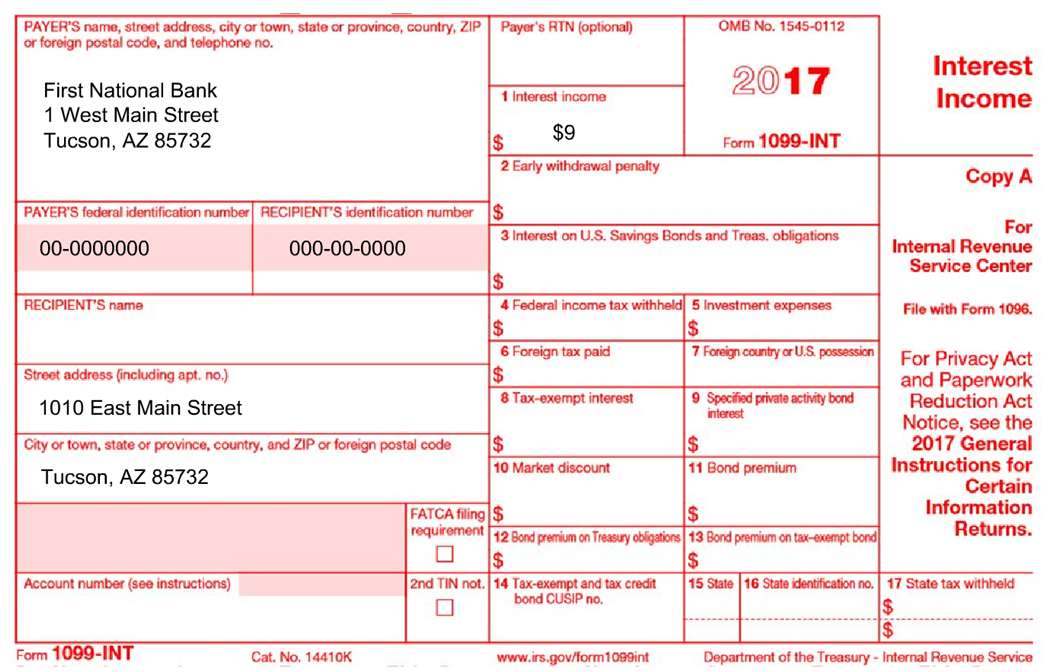

received no unemployment compensation. Using the W-2 form and the 1099-INT form below, fill out the 1040 for Juan Garcia.

The tax tables for filling out line 16 are found above.

received no unemployment compensation. Using the W-2 form and the 1099-INT form below, fill out the 1040 for Juan Garcia.

The tax tables for filling out line 16 are found above.

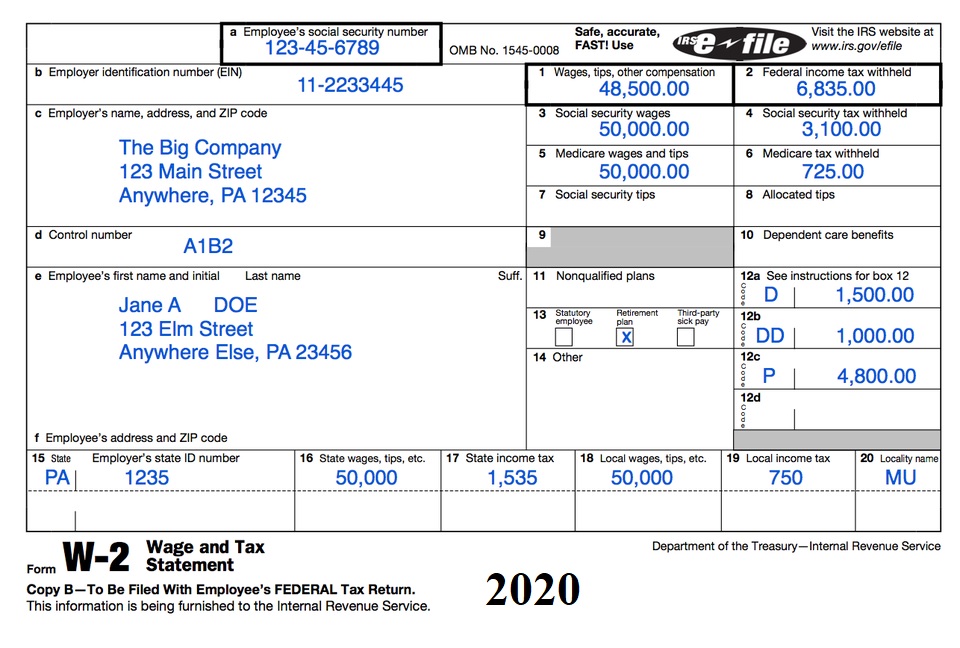

W-2 Form

1099 INT Form

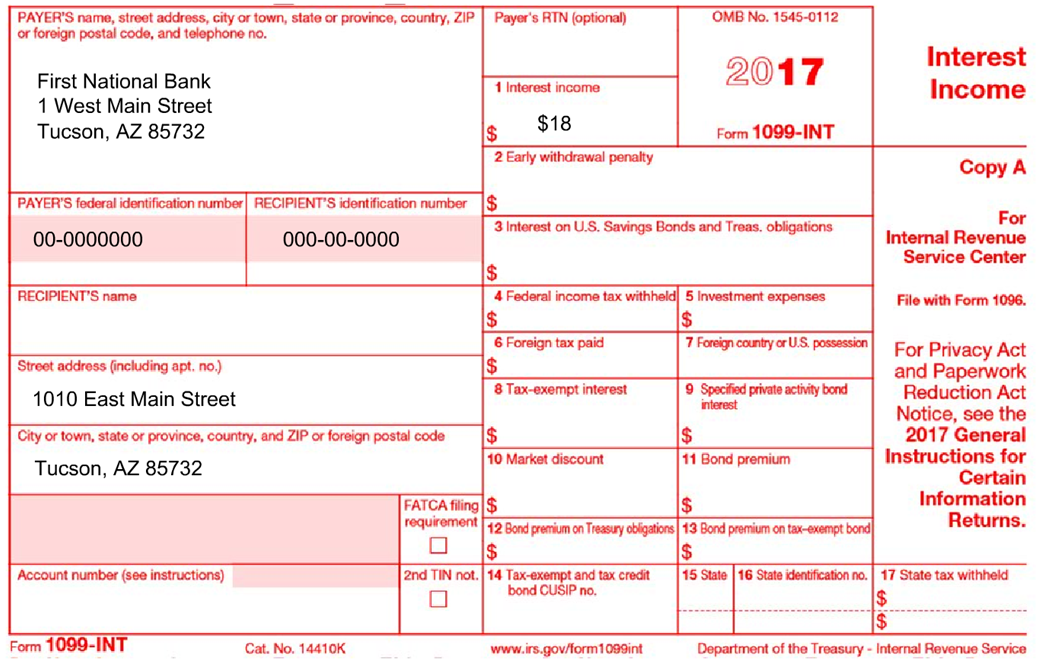

Ayana Jones is single and does not live at home with her parents and is NOT dependent upon her parents. She has no combat service

and received no unemployment compensation. Using the W-2 form and the 1099-INT form below, fill out the 1040 for Ayana Jones.

and received no unemployment compensation. Using the W-2 form and the 1099-INT form below, fill out the 1040 for Ayana Jones.

1040EZ Form

W-2 Form

1099 INT Form

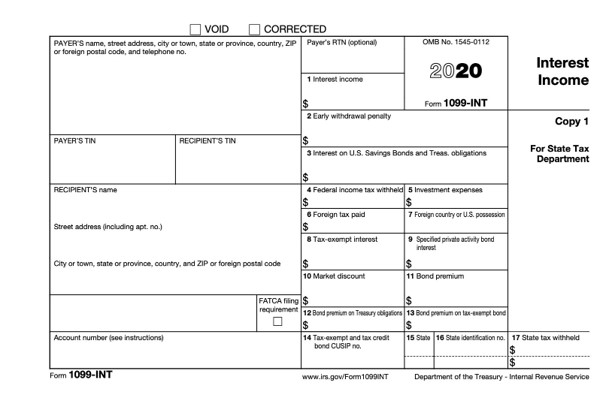

2020 Form 1040 Tax Form

This lesson on the 1040 tax form for 2020 is broken up into 4 parts:

1. Tax Forms: W-4, W-2, 1099INT, and 1040

2. Lesson on filling out the 1040 tax form.

3. Two 1040 interactive worksheet problems to help you better understand how

to fill out the form correctly.

1. Tax Forms: W-4, W-2, 1099INT, and 1040

2. Lesson on filling out the 1040 tax form.

3. Two 1040 interactive worksheet problems to help you better understand how

to fill out the form correctly.

Learn How to Fill Out the 2020 Tax Form 1040

Worksheet 1: Filling Out the 2017 Form 1040EZ for Juan Garcia

Worksheet 2: Filling Out the 2017 Form 1040EZ for Ayanna Jones

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

You will be filling out two 1040 worksheets, one for Juan Garcia and the other for Ayanna Jones. Read the paragraph for

each individual and use the 1040 to fill in information from the W-2 form and 1099-INT form to the right. You also will be

using the Tax Tables shown above and the calculator underneath the W-2 form and 1099-INT form.

each individual and use the 1040 to fill in information from the W-2 form and 1099-INT form to the right. You also will be

using the Tax Tables shown above and the calculator underneath the W-2 form and 1099-INT form.

NOTE: Teachers might want to print a two-sided copy of the 1040 Form so students can follow

along with the lesson below.

along with the lesson below.

| Steven M. Reff Economics Lecturer University of Arizona (2007 - 2016) The 2015 University of Arizona Five-Star Faculty Award |

The 1040EZ was eliminated as part of the Tax Cuts and Jobs Act of 2017. And it wasn't just the 1040EZ that

disappeared. The 1040EZ, 1040A, and standard 1040 have all been replaced for tax year 2018 with a new simplified

1040 form.

disappeared. The 1040EZ, 1040A, and standard 1040 have all been replaced for tax year 2018 with a new simplified

1040 form.

FILING STATUS: Check the correct filing status box that relates to you.

NAME, ADDRESS, CITY, STATE, ZIP: Fill in the information.

NOTE: For this lesson DO NOT fill in your Social Security number.

NOTE: For this lesson DO NOT fill in your Social Security number.

PRESIDENTIAL CAMPAIGN FUND: Checking the box YOU for the Presidential

Campaign Fund will NOT affect your tax liability (tax due) or tax refund.

Campaign Fund will NOT affect your tax liability (tax due) or tax refund.

STANDARD DEDUCTION: If you live with your parents for at least 6 months + 1 day

and you are 19 years of age or younger or 24 years old are going to school, your

parents can claim you as a dependent. Check "You as a dependent."

Test Your Knowledge:

https://apps.irs.gov/app/understandingTaxes/hows/tax_tutorials/mod04/tt_mod04_16.jsp#skillCheck

and you are 19 years of age or younger or 24 years old are going to school, your

parents can claim you as a dependent. Check "You as a dependent."

Test Your Knowledge:

https://apps.irs.gov/app/understandingTaxes/hows/tax_tutorials/mod04/tt_mod04_16.jsp#skillCheck

You have NO dependents (people who are dependent upon you for support)

INCOME and ADJUSTMENTS: The only 2020 income you have is from wages ($5,216)

that you earned working during the school year and summer. The Federal Government

took $522 out of your wages for taxes. You have earned $5.52 in interest from your

savings account and $12.13 that you earned from dividends for stock you purchased to

learn about the stock market.

that you earned working during the school year and summer. The Federal Government

took $522 out of your wages for taxes. You have earned $5.52 in interest from your

savings account and $12.13 that you earned from dividends for stock you purchased to

learn about the stock market.

The lines you will fill in are: 1, 2b, 3b, 9, 10c (is zero), 11, 12 (use the standard

deduction for a single person), 14 (is zero), and 15.

When you are finished filling in all of the information above, the correct answer is

listed below.

deduction for a single person), 14 (is zero), and 15.

When you are finished filling in all of the information above, the correct answer is

listed below.

Line 16: Using the tax tables below and the dollar amount you have on Line 15 (taxable

income), find the amount you owe as a single individual and record that dollar amount on

line 16.

Follow the instructions on the 1040 and fill in the dollar amounts on lines:

18, 21. (is zero) 22, 24, 25a $522, 25d, 26 (is zero), 32 (is zero) 33, 34. (amount of refund) OR

37 (amount you owe).

income), find the amount you owe as a single individual and record that dollar amount on

line 16.

Follow the instructions on the 1040 and fill in the dollar amounts on lines:

18, 21. (is zero) 22, 24, 25a $522, 25d, 26 (is zero), 32 (is zero) 33, 34. (amount of refund) OR

37 (amount you owe).

Juan Garcia: 1. 19200; 2b. 9; 9. 19209; 10c. (is zero); 11, 12 12400; 15. 6809; 16. 683; 18. 683; 21. 0; 22. 683; 24. 683; 25a. 2413;

25d. 2413; 26. 0; 32. 0; 33. 2413; 34. 1730 Juan OVERPAID so Juan gets a REFUND! Sign it, date it, and send it in!

25d. 2413; 26. 0; 32. 0; 33. 2413; 34. 1730 Juan OVERPAID so Juan gets a REFUND! Sign it, date it, and send it in!

Ayana Jones: 1. 35500; 2b. 18; 9. 35518; 10c. 0; 11. 35518; 12. 12400; 15. 23118; 16. 2578; 18. 2578; 22. 2578; 24. 2578; 25a. 4858;

25d. 4858; 26. 0; 32. 0; 33. 4858; 34. 2280 Ayana OVERPAID so Ayana gets a REFUND! Sign it, date it, and send it in!

25d. 4858; 26. 0; 32. 0; 33. 4858; 34. 2280 Ayana OVERPAID so Ayana gets a REFUND! Sign it, date it, and send it in!

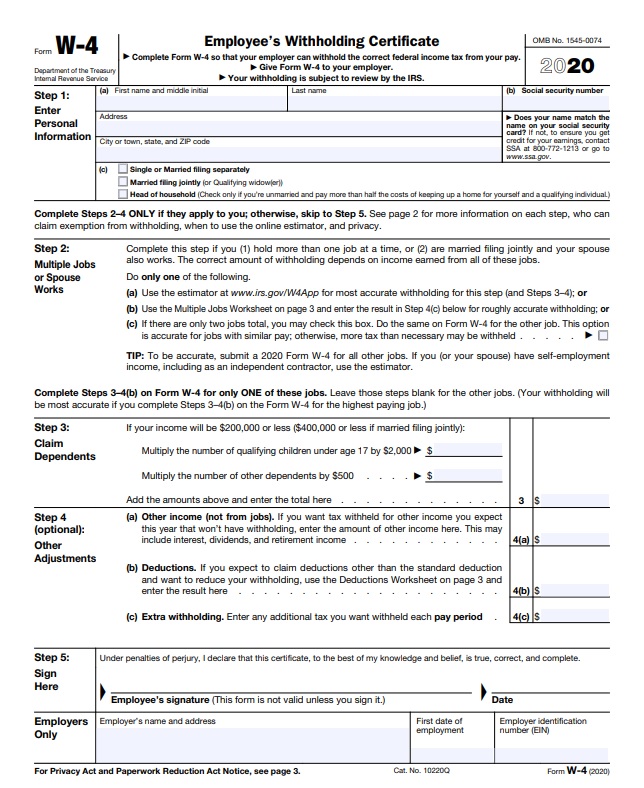

When you are hired by a

company, you will be

required to fill out the

W-4 form. It is a rather

easy form to fill out

especially if Steps 2 - 4

do not apply to you.

company, you will be

required to fill out the

W-4 form. It is a rather

easy form to fill out

especially if Steps 2 - 4

do not apply to you.

Shown below are the W-2 form (sent to you by your employer) and the 1099-INT form (sent to you by your financial

institution). Your employer (W-2 form) and your bank (1099-INT form) are required by law to send you these forms by

January 31 of the following year.

institution). Your employer (W-2 form) and your bank (1099-INT form) are required by law to send you these forms by

January 31 of the following year.

The W-2 is used to fill out your 1040 tax form that is due

no later than April 15 of the following year, unless you

file for an extension. The important boxes on your W-2

for filling out your federal taxes are boxes 1 and 2.

Box 16 will be used to fill out your state taxes.

no later than April 15 of the following year, unless you

file for an extension. The important boxes on your W-2

for filling out your federal taxes are boxes 1 and 2.

Box 16 will be used to fill out your state taxes.

The 1099-INT is sent to you by your bank and shows

how much interest you earned that you will record on

your 1040 tax form.

how much interest you earned that you will record on

your 1040 tax form.

Answers for Juan Garcia's and Ayana Jones' 1040 tax forms.

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Fill in the following lines: 1, 2b, 9, 10c. (zero), 11, 12 (single standard deduction), 14 (zero), 15 (taxable income); 16 (tax tables), 18, 21 (zero), 22, 24, 25a. (Fed.

taxes withheld on W-2), 25d, 26 (zero), 32 (zero), 33, 34. OR 37 to determine if you OWE or get a REFUND. Sign, date, send it in!

taxes withheld on W-2), 25d, 26 (zero), 32 (zero), 33, 34. OR 37 to determine if you OWE or get a REFUND. Sign, date, send it in!

YOU: 1. 5216; 2b. 5.52; 3b. 12.13; 9. 5233.65; 10c. 0; 11. 5233.65; 12. (single standard deduction); 14. 0; 15. (taxable income); 16. (tax tables); 18. 0; 21. 0; 22. 0;

24 0; 25a. 522; 25d. 522; 26. 0; 32. 0; 34. 522 -- YOU OVERPAID and GET A REFUND! Sign it, date it, and send it in!

24 0; 25a. 522; 25d. 522; 26. 0; 32. 0; 34. 522 -- YOU OVERPAID and GET A REFUND! Sign it, date it, and send it in!

Fill in the following lines: 1, 2b, 9, 10c. (zero), 11, 12 (single standard deduction), 14 (zero), 15 (taxable income); 16 (tax tables), 18, 21 (zero), 22, 24, 25a. (Fed.

taxes withheld on W-2), 25d, 26 (zero), 32 (zero), 33, 34. OR 37 to determine if you OWE or get a REFUND. Sign, date, send it in!

taxes withheld on W-2), 25d, 26 (zero), 32 (zero), 33, 34. OR 37 to determine if you OWE or get a REFUND. Sign, date, send it in!

Fill in the following lines: 1, 2b, 9, 10c. (zero), 11, 12 (single standard deduction), 14 (zero), 15 (taxable income); 16 (tax tables), 18, 21 (zero), 22, 24, 25a. (Fed.

taxes withheld on W-2), 25d, 26 (zero), 32 (zero), 33, 34. OR 37 to determine if you OWE or get a REFUND. Sign, date, send it in!

taxes withheld on W-2), 25d, 26 (zero), 32 (zero), 33, 34. OR 37 to determine if you OWE or get a REFUND. Sign, date, send it in!