| Steven M. Reff Economics Lecturer University of Arizona (2007 - 2016) The 2015 University of Arizona Five-Star Faculty Award |

Inside the AP® Macroeconomics Classroom CED, Topic 4.6 Monetary Policy, the term "policy rate"

is used just 2 times.

*Many central banks carry out policy to hit a target range for an overnight interbank lending rate,

sometimes referred to as the central bank’s policy rate. (In the United States, this is the federal funds rate.)

*the other time policy rate is used is on the y axis label of The Reserve Market Graph below to the left.

(I created an interactive graph of this next to it where you can move S and D and draw on the graph

with your finger, cursor, or a computer pen.)

is used just 2 times.

*Many central banks carry out policy to hit a target range for an overnight interbank lending rate,

sometimes referred to as the central bank’s policy rate. (In the United States, this is the federal funds rate.)

*the other time policy rate is used is on the y axis label of The Reserve Market Graph below to the left.

(I created an interactive graph of this next to it where you can move S and D and draw on the graph

with your finger, cursor, or a computer pen.)

ALSO:

Inside the AP® Macroeconomics Classroom CED, the term "interest on reserves" is used just 2 times.

*(The banking system in the United States has ample reserves, and the Federal Reserve’s key policy tool is interest on reserves.)

*the other time interest on reserves is used is in the multiple choice question with a graph shown below.

The interactive graph I created to the right of the multiple choice question shows what happens with monetary

policy related to the multiple choice question to BOTH interest on reserves and the policy rate (Federal Funds Rate).

The FOMC determines the effective FFR (the policy rate) and the Board of Governors sets the interest on reserves (IOR)

to move the target in the desired direction.

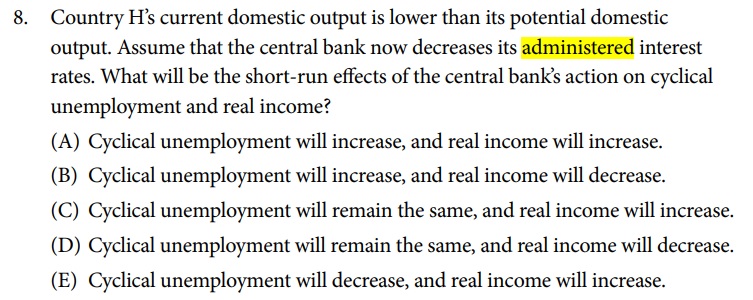

In the multiple choice question below, the economy is experiencing an inflationary gap. The FOMC sets the upper and lower target

for the FFR. The FRB takes these notes from the FOMC and sets the three administered rates:

1) Interest paid on Reserves (IOR) which is the primary tool of monetary policy

2) Primary Credit Rate, formerly known as the Discount Rate

3) Interest paid on Overnight Reverse Repurchase Agreements among Primary Dealers

In the multiple choice question below, the FOMC would raise the upper and lower FFR target limits. The Board of Governors then would raise the interest on reserves to accomplish the goal of raising the FFR. As short term rates rise (FFR), this increases long-term rates, which decreases C and I, which decreases AD, and thus decreases the PL.

Inside the AP® Macroeconomics Classroom CED, the term "interest on reserves" is used just 2 times.

*(The banking system in the United States has ample reserves, and the Federal Reserve’s key policy tool is interest on reserves.)

*the other time interest on reserves is used is in the multiple choice question with a graph shown below.

The interactive graph I created to the right of the multiple choice question shows what happens with monetary

policy related to the multiple choice question to BOTH interest on reserves and the policy rate (Federal Funds Rate).

The FOMC determines the effective FFR (the policy rate) and the Board of Governors sets the interest on reserves (IOR)

to move the target in the desired direction.

In the multiple choice question below, the economy is experiencing an inflationary gap. The FOMC sets the upper and lower target

for the FFR. The FRB takes these notes from the FOMC and sets the three administered rates:

1) Interest paid on Reserves (IOR) which is the primary tool of monetary policy

2) Primary Credit Rate, formerly known as the Discount Rate

3) Interest paid on Overnight Reverse Repurchase Agreements among Primary Dealers

In the multiple choice question below, the FOMC would raise the upper and lower FFR target limits. The Board of Governors then would raise the interest on reserves to accomplish the goal of raising the FFR. As short term rates rise (FFR), this increases long-term rates, which decreases C and I, which decreases AD, and thus decreases the PL.

With the above being said though . . .

Inside the AP® Macroeconomics Classroom CED, the term "administered rates" is used 5 times.

The tools of monetary policy may include the central bank’s discount rate and other administered interest rates (e.g., interest on

reserves), open market operations, and the required reserve ratio. The tools used and the way in which they are implemented differ

between economies that have limited reserves in their banking system and economies that have ample reserves in their banking

system.

The administered interest rates are:

*Primary Credit Rate (that used to be called the Discount Rate up until January 8, 2003). This rate is set by the Board of Governors

a certain number of basis points above the Federal Funds Rate. So as the FED funds rate rises, the PCR rises at the same time.

*Interest on Reserve Balances (IORB) or IOR. As IOR rises, the FED funds rate rises, and the PCR rises.

*Interest on Overnight Reverse Repurchase Agreement (ON RRP) -- Students do not have to know this or anything about arbitrage.

The policy rate is the:

*Federal Funds Rate

Inside the AP® Macroeconomics Classroom CED, the term "administered rates" is used 5 times.

The tools of monetary policy may include the central bank’s discount rate and other administered interest rates (e.g., interest on

reserves), open market operations, and the required reserve ratio. The tools used and the way in which they are implemented differ

between economies that have limited reserves in their banking system and economies that have ample reserves in their banking

system.

The administered interest rates are:

*Primary Credit Rate (that used to be called the Discount Rate up until January 8, 2003). This rate is set by the Board of Governors

a certain number of basis points above the Federal Funds Rate. So as the FED funds rate rises, the PCR rises at the same time.

*Interest on Reserve Balances (IORB) or IOR. As IOR rises, the FED funds rate rises, and the PCR rises.

*Interest on Overnight Reverse Repurchase Agreement (ON RRP) -- Students do not have to know this or anything about arbitrage.

The policy rate is the:

*Federal Funds Rate

| Monetary Policy, Ample Reserves, and the CED |

In the multiple choice question above Country H is

experiencing an output gap (lower than its potential

domestic output). If the FED decreases its administered

interest rates (IOR) which lowers the FFR (policy rate), this

will lower long-term rates which increase C and I which

increases AD which decreases cyclical unemployment, and

increases RGDP and real Y.

The correct answer is E.

experiencing an output gap (lower than its potential

domestic output). If the FED decreases its administered

interest rates (IOR) which lowers the FFR (policy rate), this

will lower long-term rates which increase C and I which

increases AD which decreases cyclical unemployment, and

increases RGDP and real Y.

The correct answer is E.

AP® is a trademark registered and owned by The College Board®, which is not affiliated

with, and does not endorse, this website, reffonomics.com, Joel Miller, Matt Pedlow,

Steven Reff, or FEE.org.

with, and does not endorse, this website, reffonomics.com, Joel Miller, Matt Pedlow,

Steven Reff, or FEE.org.

The below Enduring Understanding, Learning Objectives, and Essential Knowledge are from

the AP® Macroeconomics Course and Exam Description, Effective Fall 2020

(collegeboard.org).

*AP® and Advanced Placement are registered trademarks of The College Board® which is

not affiliated with online.reffonomics.com, FEE.org, nor does it endorse this Principles of

Macroeconomics Course Curriculum.

the AP® Macroeconomics Course and Exam Description, Effective Fall 2020

(collegeboard.org).

*AP® and Advanced Placement are registered trademarks of The College Board® which is

not affiliated with online.reffonomics.com, FEE.org, nor does it endorse this Principles of

Macroeconomics Course Curriculum.