| The Present (15 minutes) |

| Monetary Policy -- The Present |

A special thank you goes to:

The Council on Economics Education (councilforeconed.org) for accepting my proposal to present at the

62nd Financial Literacy & Economics Education Conference in Fr. Lauderdale, Florida, on September 24, 2023.

The Council on Economics Education (councilforeconed.org) for accepting my proposal to present at the

62nd Financial Literacy & Economics Education Conference in Fr. Lauderdale, Florida, on September 24, 2023.

The Foundation for Economics Education (teachers.fee.org), established in 1946, that provided funding for

me to present at this conference. FEE.org provides "FREE" economics curriculum for teachers to use inside

and outside their classrooms.

me to present at this conference. FEE.org provides "FREE" economics curriculum for teachers to use inside

and outside their classrooms.

The Federal Reserve Bank of St. Louis for allowing the public to use their important graphing resources --

(FRED) -- to help economics educators get the most up-to-date information on economic data at our finger

tips.

(FRED) -- to help economics educators get the most up-to-date information on economic data at our finger

tips.

| Setting Today's Goals for the FED was The Federal Reserve Reform Act of 1977 |

| Steven M. Reff Economics Lecturer University of Arizona (2007 - 2016) The 2015 University of Arizona Five-Star Faculty Award |

| Teach the Differences Among |

| To use the interactive Dual Mandate Bullseye follow the directions underneath the graph. |

On the Dual Mandate Bullseye below:

shown on the x axis is the unemployment rate. The bullseye indicates where the Natural Rate of Unemployment lies at a

certain period of time. The natural rate of unemployment is the unemployment rate that would exist when the economy

produces full-employment real output (representing Maximum Employment).

shown on the y axis is the inflation rate determined by the Personal Consumption Expnditure Index, an inflation index

used by the Federal Reserve. The FED targeted inflation rate is 2% (representing Stable Prices).

shown on the x axis is the unemployment rate. The bullseye indicates where the Natural Rate of Unemployment lies at a

certain period of time. The natural rate of unemployment is the unemployment rate that would exist when the economy

produces full-employment real output (representing Maximum Employment).

shown on the y axis is the inflation rate determined by the Personal Consumption Expnditure Index, an inflation index

used by the Federal Reserve. The FED targeted inflation rate is 2% (representing Stable Prices).

2023 Federal Open Market Committee (FOMC) Committee Members

• Jerome H. Powell, Board of Governors, Chair

• Michael S. Barr, Board of Governors

• Michelle W. Bowman, Board of Governors

• Lael Brainard, Board of Governors (resigned February 14)

• Lisa D. Cook, Board of Governors

• Philip N. Jefferson, Board of Governors

• Christopher J. Waller, Board of Governors

• John C. Williams, New York, Vice Chair

• James Bullard, St. Louis

• Susan M. Collins, Boston

• Esther L. George, Kansas City

• Loretta J. Mester, Cleveland

• Jerome H. Powell, Board of Governors, Chair

• Michael S. Barr, Board of Governors

• Michelle W. Bowman, Board of Governors

• Lael Brainard, Board of Governors (resigned February 14)

• Lisa D. Cook, Board of Governors

• Philip N. Jefferson, Board of Governors

• Christopher J. Waller, Board of Governors

• John C. Williams, New York, Vice Chair

• James Bullard, St. Louis

• Susan M. Collins, Boston

• Esther L. George, Kansas City

• Loretta J. Mester, Cleveland

2023 Board of Governors of the Federal Reserve System (FRB)

• Jerome H. Powell, Board of Governors, Chair

• Michael S. Barr, Board of Governors, Vice Chair for Supervision

• Michelle W. Bowman, Board of Governors

• Lael Brainard, Board of Governors, Vice Chair

(resigned on February 14, 2023 to become the Director of the

National Economic Council at the White House)

• Lisa D. Cook, Board of Governors

• Philip N. Jefferson, Board of Governors

• Christopher J. Waller, Board of Governors

• Jerome H. Powell, Board of Governors, Chair

• Michael S. Barr, Board of Governors, Vice Chair for Supervision

• Michelle W. Bowman, Board of Governors

• Lael Brainard, Board of Governors, Vice Chair

(resigned on February 14, 2023 to become the Director of the

National Economic Council at the White House)

• Lisa D. Cook, Board of Governors

• Philip N. Jefferson, Board of Governors

• Christopher J. Waller, Board of Governors

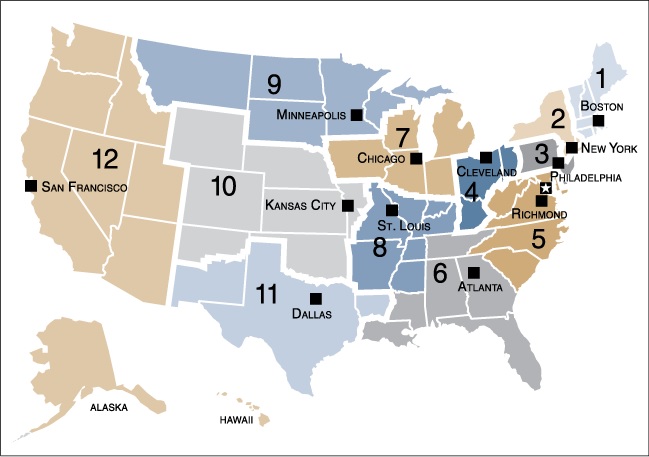

The maximum number of members who sit on the Federal Open

Market Committee (FOMC) consists of 12 members. Notice above

that the FOMC had this maximum number as of February 13:

7 members of the Board of Governors of the Federal Reserve

System as of February 13, 2023.

1 President of the Federal Reserve Bank of New York always

sits on the FOMC

4 of the remaining eleven Reserve Bank presidents, who serve

one-year terms on a rotating basis. (See district bank map below)

Market Committee (FOMC) consists of 12 members. Notice above

that the FOMC had this maximum number as of February 13:

7 members of the Board of Governors of the Federal Reserve

System as of February 13, 2023.

1 President of the Federal Reserve Bank of New York always

sits on the FOMC

4 of the remaining eleven Reserve Bank presidents, who serve

one-year terms on a rotating basis. (See district bank map below)

The maximum number of governors who sit on The Board of

Governors of the Federal Reserve is 7 governors.

Notice above as of February 13, 2023 the Board had the maximum

number.

The members of the Board of Governors of the Federal Reserve

System are nominated by the President and confirmed

by the Senate. A full term is 14 years.

The Chair and the Vice Chair of the Board, as well as the Vice

Chair for Supervision, are nominated by the President from among

the members and are confirmed by the Senate. They serve a term

of four years.

Governors of the Federal Reserve is 7 governors.

Notice above as of February 13, 2023 the Board had the maximum

number.

The members of the Board of Governors of the Federal Reserve

System are nominated by the President and confirmed

by the Senate. A full term is 14 years.

The Chair and the Vice Chair of the Board, as well as the Vice

Chair for Supervision, are nominated by the President from among

the members and are confirmed by the Senate. They serve a term

of four years.

The interest rate on reserve balances (IORB rate) and the primary

credit rate (formerly known as the discount rate) are determined

by the FRB). IORB is the primary tool for the Federal Reserve's

monetary policy.

credit rate (formerly known as the discount rate) are determined

by the FRB). IORB is the primary tool for the Federal Reserve's

monetary policy.

| The Board of Governors meet every other Monday. |

| The Federal Open Market Committee (FOMC) that meets 8 times each year. Remember this Committee also includes the members of the Board of Governors. |

12 Federal Reserve District Bank Presidents

The New York Federal Reserve District Bank President and

4 Federal Reserve District Bank Presidents sit on the

Federal Open Market Committee (FOMC)

The remaining 7 Federal Reserve Bank Presidents attend

the FOMC meetings and bring their district board reports

to help advise The Board of Governors on the

Primary Credit Rate (formerly entitled the Discount Rate)

that should be administered. The Board of Governors

then makes the final decision on this rate.

The New York Federal Reserve District Bank President and

4 Federal Reserve District Bank Presidents sit on the

Federal Open Market Committee (FOMC)

The remaining 7 Federal Reserve Bank Presidents attend

the FOMC meetings and bring their district board reports

to help advise The Board of Governors on the

Primary Credit Rate (formerly entitled the Discount Rate)

that should be administered. The Board of Governors

then makes the final decision on this rate.

| The Federal Open Market Committee (FOMC), the Board of Governors, and the 12 District Bank Presidents |

Students must have an understanding of the three entities involved in setting the direction of monetary policy (FOMC, Board of Governors, and the

12 District Bank Presidents) before learning about the FED's Ample Reserves policies.

12 District Bank Presidents) before learning about the FED's Ample Reserves policies.

The Board of Governors of the Federal Reserve

System and the Federal Open Market Committee

shall maintain long run growth of the monetary

and credit aggregates commensurate with the

economy's long run potential to increase

production, so as to promote effectively the

goals of:

Maximum Employment

Stable Prices

Moderate Long-Term Interest Rates

NOTE: Even though the FED was assigned three

goals, it has long been termed The Dual Mandate of:

Maximum Employment

Stable Prices

System and the Federal Open Market Committee

shall maintain long run growth of the monetary

and credit aggregates commensurate with the

economy's long run potential to increase

production, so as to promote effectively the

goals of:

Maximum Employment

Stable Prices

Moderate Long-Term Interest Rates

NOTE: Even though the FED was assigned three

goals, it has long been termed The Dual Mandate of:

Maximum Employment

Stable Prices

| The Dual Mandate Bullseye created by the Federal Reserve |

NOTE: Shown on the Bullseye above

and shown on the FRED graph to the left,

starting with the July, 2021, the "Natural

Rate of Unemployment (Long-Term)" name

has changed to the "Noncyclical Rate of

Unemployment".

Both of these terms represent the sum of

frictional and structural unemployment.

and shown on the FRED graph to the left,

starting with the July, 2021, the "Natural

Rate of Unemployment (Long-Term)" name

has changed to the "Noncyclical Rate of

Unemployment".

Both of these terms represent the sum of

frictional and structural unemployment.