Purchasing a Home

USING CALCULATOR.NET:

Let's say you are looking to purchase a $225,000 house and you put roughly 10% down. This means you are going

to borrow roughly $200,000. ($225,000 x .10 = $22,500 down payment.) $225,000 - $22,500 = roughly $200,000).

Inside the calculator below enter the following information:

Loan Amount: $200,000 (Mortgage Amount)

Loan Term: 30 years (Mortgage Years)

Interest Rate: Your State's Average Interest Rate from the PopUp window above.

Let's say you are looking to purchase a $225,000 house and you put roughly 10% down. This means you are going

to borrow roughly $200,000. ($225,000 x .10 = $22,500 down payment.) $225,000 - $22,500 = roughly $200,000).

Inside the calculator below enter the following information:

Loan Amount: $200,000 (Mortgage Amount)

Loan Term: 30 years (Mortgage Years)

Interest Rate: Your State's Average Interest Rate from the PopUp window above.

NOTE: This website has its scroll bar located to the far right. Inside this website are

embedded websites that have their own scrollbars.

embedded websites that have their own scrollbars.

Always remember when you purchase a house and start making payments, it is truly a PITI (sounds like pity).

Principal

Interest

Taxes (real estate)

Insurance

Your monthly payment will include Principal and Interest that you owe your financial institution + real estate

Taxes + house Insurance.

Let's look at these terms starting with Principal and Interest:

Principal is the sum of money borrowed that remains unpaid. Let's say you purchase a home for $225,000

and put roughly 10% down. This means you borrowed roughly $200,000 to purchase your starter home. This

is called the principal amount you owe the financial institution. The good thing is every payment you make to

the financial institution (bank, credit union, etc.), you owe that institution less since some of your payment

goes to pay interest and some of your payment goes to pay down the principal. After you make your first

payment, you owe the bank less principal and this continues until the mortgage is paid off. You'll be seeing

how this works using the amortization schedule calculator below.

Interest Rate is the rate of return the financial institution receives for your borrowing of their money. This rate

is usually stated as an annual percentage rate (APR).

Taxes (real estate) is a tax on your property (also known as property tax) and is usually included as a part of

your monthly mortgage payment.

Insurance (homeowners) provides coverage from loss to property. The financial institution that is lending

you the money generally requires you to have insurance on your house to protect itself in case of damage to

the property.

Let's say you have done your due diligence and have been pre-approved for a mortgage while you are looking

for your starter home. By doing this the seller knows the financial institution has examined (vetted) your credit

worthiness and this is a good first step before purchasing your starter home.

Embedded Websites: Bankrate.com https://www.bankrate.com/calculators/mortgages/amortization-calculator.aspx

Reffonomics.com and its author are not responsible for what the reader does with the material inside the

embedded links or the hyperlinks above.

embedded links or the hyperlinks above.

What does it mean when a house is in escrow?:

https://budgeting.thenest.com/mean-house-escrow-24004.html

https://budgeting.thenest.com/mean-house-escrow-24004.html

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Using the calculator

above, you can

estimate your

homeowner's

insurance by taking

the purchase price of

the home divided by

1,000 and multiplied

by $3.50.

Example:

You purchased a

$200,000 house.

Take $200,000

divided by 1,000

= $200

$200 x $3.50 = $700

$700 / 12 (months) =

$58.33 per month.

Use the calculator

above to do your

figuring.

above, you can

estimate your

homeowner's

insurance by taking

the purchase price of

the home divided by

1,000 and multiplied

by $3.50.

Example:

You purchased a

$200,000 house.

Take $200,000

divided by 1,000

= $200

$200 x $3.50 = $700

$700 / 12 (months) =

$58.33 per month.

Use the calculator

above to do your

figuring.

| Monthly P + I |

Using the embedded website below, figure your

estimated annual real estate taxes. To figure

your monthly payment of real estate taxes

take the annual real estate taxes divided by 12.

(Use the calculator to the right and round to

the nearest dollar amount.)

estimated annual real estate taxes. To figure

your monthly payment of real estate taxes

take the annual real estate taxes divided by 12.

(Use the calculator to the right and round to

the nearest dollar amount.)

+ Real Estate Taxes

+ Insurance (Home)

Here is the last step in figuring your monthly house

payment. Enter the above information inside the

calculator above and round to the nearest dollar

amount.

payment. Enter the above information inside the

calculator above and round to the nearest dollar

amount.

This doesn't include your up front costs of

purchasing the house (down payment, points,

closing costs) or any of your major maintanence

costs (new roof every 20 to 30 years, new heating

and air conditioning system if it breaks down,

house painting every so often, and so on).

Hardware stores will become one of your best

friends for the first few years of living in your house.

One of the best financial feelings you will have in

life is when you pay off your mortgage (P + I).

You then only have real estate Taxes +

homeowner's Insurance to pay.

purchasing the house (down payment, points,

closing costs) or any of your major maintanence

costs (new roof every 20 to 30 years, new heating

and air conditioning system if it breaks down,

house painting every so often, and so on).

Hardware stores will become one of your best

friends for the first few years of living in your house.

One of the best financial feelings you will have in

life is when you pay off your mortgage (P + I).

You then only have real estate Taxes +

homeowner's Insurance to pay.

Remember in the beginning of this lesson you

learned when you purchase a home it is a PITI

(Principal, Interest, Taxes, and Insurance). If you

entered the numbers correctly, you now have your

monthly house payment for the life of the mortgage.

learned when you purchase a home it is a PITI

(Principal, Interest, Taxes, and Insurance). If you

entered the numbers correctly, you now have your

monthly house payment for the life of the mortgage.

Mortgage is a loan that a financial institution or mortgage lender gives you so you can

purchase your house. The mortgage is a lien (you owe) on your house. If you fail to pay

your mortgage payment, the financial institution can start foreclosure proceedings to take

possession of your house. Your house becomes the financial institution's house. It is

important you make your mortgage payments on time to keep your good credit rating.

purchase your house. The mortgage is a lien (you owe) on your house. If you fail to pay

your mortgage payment, the financial institution can start foreclosure proceedings to take

possession of your house. Your house becomes the financial institution's house. It is

important you make your mortgage payments on time to keep your good credit rating.

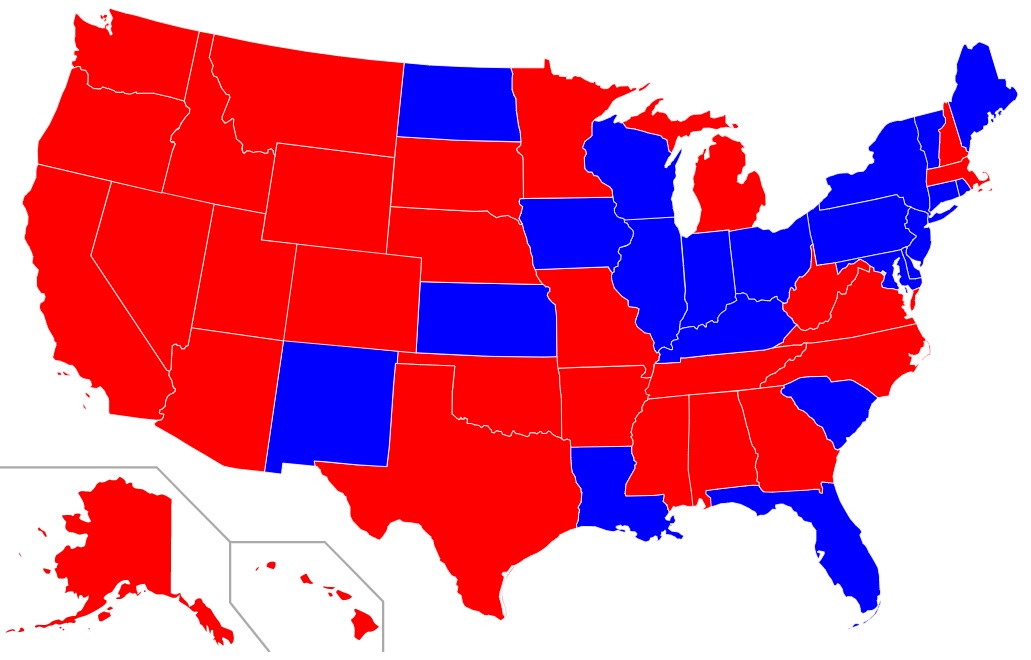

In the red states, the financial institution keeps the title to

your house and has a lien against the house until your

mortgage is paid off. In the blue states, you keep the title to

your house, but the financial institution still has a lien against

your house until your mortgage is paid off.

your house and has a lien against the house until your

mortgage is paid off. In the blue states, you keep the title to

your house, but the financial institution still has a lien against

your house until your mortgage is paid off.

Down Payment is the initial payment for purchasing the house. The average down payment amount for starter

home buyers falls somewhere between 5 and 10 percent (2017). For example, if you are going to purchase a

$300,000 home, you will have a down payment of between 5% - 10% or the purchase price or $15,000 to $30,000

down payment. As Mr. or Ms. Cheapo, you better start saving your money now.

home buyers falls somewhere between 5 and 10 percent (2017). For example, if you are going to purchase a

$300,000 home, you will have a down payment of between 5% - 10% or the purchase price or $15,000 to $30,000

down payment. As Mr. or Ms. Cheapo, you better start saving your money now.

You are ready to purchase your starter home (first home); however,

before you do, you MUST understand some basic real estate terminology.

before you do, you MUST understand some basic real estate terminology.

Add Monthly P + I + T + I

| Click on the blue box Monthly Schedule link above. If you do NOT do this, you will have difficulty finishing this lesson as you scroll down. |

Notice the column headings for the amortization schedule:

Payment Number

Beginning Balance (this is your monthly payment for Principal + Interest)

Interest (the amount of your monthly payment that goes to pay the interest)

Principal (the amount of your monthly payment that goes to pay down

the principal amount you borrowed)

Ending Balance (the amount you owe the bank as the months go by)

NOTE: The calculator DOES NOT include the down payment, real estate

taxes, or house insurance.

Payment Number

Beginning Balance (this is your monthly payment for Principal + Interest)

Interest (the amount of your monthly payment that goes to pay the interest)

Principal (the amount of your monthly payment that goes to pay down

the principal amount you borrowed)

Ending Balance (the amount you owe the bank as the months go by)

NOTE: The calculator DOES NOT include the down payment, real estate

taxes, or house insurance.

Notice as you scroll down the Monthly Amortization schedule, the following

things occur:

Beginning and Ending Balance keep going down by the amount of your

monthly payment.

Interest is still rather large in the beginning but falling.

Principal is still rather small in the beginning but rising.

The ending balance is the amount you would owe the bank if you were to

sell your home before paying off your mortgage. The difference between

the sales price of your home (minus closing costs) and what you owe the

bank is the equity you have built up in your home.

things occur:

Beginning and Ending Balance keep going down by the amount of your

monthly payment.

Interest is still rather large in the beginning but falling.

Principal is still rather small in the beginning but rising.

The ending balance is the amount you would owe the bank if you were to

sell your home before paying off your mortgage. The difference between

the sales price of your home (minus closing costs) and what you owe the

bank is the equity you have built up in your home.

Realize that if home market values climb, then you build up more equity in your

house. But, if home market values fall as they did during The Great Recession

then you lose more equity in your house.

house. But, if home market values fall as they did during The Great Recession

then you lose more equity in your house.

After 30 years, look at the Interest Total you have paid on your mortgage. This figure might shock you.

To figure your true monthly payment you must add your monthly payment (P + I) from the monthly calculator + real estate

Taxes + homeowner's Insurance.

Using the information below, calculate your monthly payment for your starter home.

To figure your true monthly payment you must add your monthly payment (P + I) from the monthly calculator + real estate

Taxes + homeowner's Insurance.

Using the information below, calculate your monthly payment for your starter home.

Embedded Websites: Smartasset.com https://smartasset.com/taxes/property-taxes#THzo6ScJsY

Search for a house on Zillow.com to see what houses cost in your neighborhood. Choose a house and go through the assignment above

and figure out what your monthly payment will be after your down payment. Then look at the amortization schedule and figure your TOTAL

monthly payment just like you did in your example of your starter home:

http://zillow.com

and figure out what your monthly payment will be after your down payment. Then look at the amortization schedule and figure your TOTAL

monthly payment just like you did in your example of your starter home:

http://zillow.com

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

| Steven M. Reff Economics Lecturer University of Arizona (2007 - 2016) The 2015 University of Arizona Five-Star Faculty Award |

Click on button below to find the

average mortgage rate in your state.

REMEMBER THIS PERCENTAGE

NUMBER!

average mortgage rate in your state.

REMEMBER THIS PERCENTAGE

NUMBER!

After finding your state

average mortgage rate,

close the popup window

above.

average mortgage rate,

close the popup window

above.

- - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Buying your first house:

Click the green Calculate button and see what your monthly P + I payment is.

Payment

Number

Number

Beginning

Balance

Balance

Interest

Principal

Ending

Balance

Balance

Your monthly P + I is the amount you pay each

month to your financial institution (bank). This

figure is found above in the green box that

states Monthly Pay.

month to your financial institution (bank). This

figure is found above in the green box that

states Monthly Pay.