| Steven M. Reff Economics Lecturer University of Arizona (2007 - 2016) The 2015 University of Arizona Five-Star Faculty Award |

Yf

Yc

RGDP = Y

PL

PLf

PLc

PL

Yf

Yc

RGDP = Y

PLf

PLc

PL

Yf

Yc

up

RGDP = Y

PL

PLc

PLf

| ASAD Graph Below Full Employment Recessionary Gap |

| ASAD Graph Beyond Full Employment Inflationary Gap |

The Dual Mandate Bullseye

Ample Reserves Regime Flow Chart (Below Full Employment)

Ample Reserves Regime Flow Chart (Beyond Full Employment)

Ample-Reserves Regime Graph

Ample-Reserves Regime Graph -- In Its Entirety

The Ample Reserves Regime Graph and What Does It Mean to You?

Important History Dates of the Federal Reserve System

For many years, reserve requirements played a central role in the implementation of monetary policy by creating a

stable demand for reserves. In January 2019, the FOMC announced its intention to implement monetary policy in an

ample reserves regime. Reserve requirements do not play a significant role in this operating framework.

As announced on March 15, 2020, the Board reduced reserve requirement ratios to zero percent, effective March 26,

2020, in light of the shift to an ample-reserves regime. This action eliminates the need for thousands of depository

institutions to maintain balances in accounts at Reserve Banks to satisfy reserve requirements, thereby freeing up

liquidity in the banking system to support lending to households and businesses.

https://www.frbservices.org/resources/central-bank/faq/reserve-account-admin-app.html

stable demand for reserves. In January 2019, the FOMC announced its intention to implement monetary policy in an

ample reserves regime. Reserve requirements do not play a significant role in this operating framework.

As announced on March 15, 2020, the Board reduced reserve requirement ratios to zero percent, effective March 26,

2020, in light of the shift to an ample-reserves regime. This action eliminates the need for thousands of depository

institutions to maintain balances in accounts at Reserve Banks to satisfy reserve requirements, thereby freeing up

liquidity in the banking system to support lending to households and businesses.

https://www.frbservices.org/resources/central-bank/faq/reserve-account-admin-app.html

1977 Federal Reserve Act (Dual Mandate)

Concluding Thoughts on the Ample Reserves Regime

The Board of Governors of the Federal Reserve System and the Federal Open Market Committee (FOMC) shall maintain

long-run growth of the monetary and credit totals proportionate with the economy's long-run potential to increase

production, so as to promote effectively the goals of:

Maximum Employment

Stable Prices

Moderate Long-Term Interest Rates

Even though the Federal Reserve Act of 1977 has three goals, these are known as the "Dual Mandate" --

maximum employment and stable prices.

long-run growth of the monetary and credit totals proportionate with the economy's long-run potential to increase

production, so as to promote effectively the goals of:

Maximum Employment

Stable Prices

Moderate Long-Term Interest Rates

Even though the Federal Reserve Act of 1977 has three goals, these are known as the "Dual Mandate" --

maximum employment and stable prices.

On the Dual Mandate Bullseye below, shown on the y axis is the inflation rate determined by the Personal Consumption

Expenditure Index, an inflation index used by the Federal Reserve. The targeted inflation rate by the FOMC is 2% (stable

prices). Shown on the x axis is the unemployment rate. The bullseye indicates where the Natural Rate of Unemployment

(maximum employment) lies at a certain period of time.

Expenditure Index, an inflation index used by the Federal Reserve. The targeted inflation rate by the FOMC is 2% (stable

prices). Shown on the x axis is the unemployment rate. The bullseye indicates where the Natural Rate of Unemployment

(maximum employment) lies at a certain period of time.

Federal Reserve's NEW Ample-Reserves Regime

In general, any counterparty that can use the ON RRP facility should be unwilling to invest funds overnight with another

counterparty at a rate below the ON RRP rate, just as any commercial bank eligible to earn interest on reserves should be

unwilling to invest funds overnight with another commercial bank at a rate below the interest rate on excess reserves.

counterparty at a rate below the ON RRP rate, just as any commercial bank eligible to earn interest on reserves should be

unwilling to invest funds overnight with another commercial bank at a rate below the interest rate on excess reserves.

Rip out any lesson about the money market graph, unless

you want to learn a history lesson about this graph.

you want to learn a history lesson about this graph.

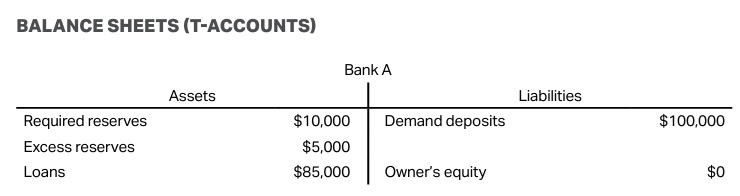

Rip out any lesson on the bank's balance sheet, unless you

want to teach a history lesson about it. Rather, students

should understand the balance sheet of the Federal Reserve.

want to teach a history lesson about it. Rather, students

should understand the balance sheet of the Federal Reserve.

Below is a short video from The Dead Poets Society

starring Robin Williams where he instructs his students to

rip out pages from their poetry book which should happen

to many of the pages in economics textbooks that relate to

monetary policy of the past. Also, it is quite ironic that

Robin Williams draws a graph about poetry on the

blackboard, as graphs tell important stories in economics.

starring Robin Williams where he instructs his students to

rip out pages from their poetry book which should happen

to many of the pages in economics textbooks that relate to

monetary policy of the past. Also, it is quite ironic that

Robin Williams draws a graph about poetry on the

blackboard, as graphs tell important stories in economics.

To use the interactive Dual Mandate Bullseye follow the directions underneath the graph.

To further expand upon the Dual Mandate, the information below comes from the Statement on

Longer-Run Goals and Monetary Policy Strategy, adopted effective January 24, 2012; as amended

effective January 29, 2019.

Maximum Employment

The maximum level of employment is largely determined by nonmonetary factors that affect the

structure and dynamics of the labor market. These factors may change over time and may not be

directly measurable. Consequently, it would not be appropriate to specify a fixed goal for

employment; rather, the Committee’s policy decisions must be informed by assessments of the

maximum level of employment, recognizing that such assessments are necessarily uncertain and

subject to revision. The Committee considers a wide range of indicators in making these

assessments. Information about Committee participants’ estimates of the longer-run normal rates

of output growth and unemployment is published four times per year in the FOMC’s Summary of

Economic Projections. For example, in the most recent projections, the median of FOMC

participants’ estimates of the longer run normal rate of unemployment was 4.4 percent.

NOTE: There is a difference between Maximum Employment used by the Federal Reserve and the

Natural Rate of Unemployment (used in the Dual Mandate graph above) which the CBO

(Congressional Budget Office) defines the natural rate of unemployment as “the rate of

unemployment that arises from all sources other than fluctuations in demand associated with

business cycles.” Maximum employment and the natural rate of unemployment are not identical,

but do tend to move in the same direction over time.

Stable Prices

The Committee reaffirms its judgment that inflation at the rate of 2 percent, as measured by the

annual change in the price index for personal consumption expenditures, is most consistent over

the longer run with the Federal Reserve’s statutory mandate.

Moderate Long-Term Interest Rates

Communicating this inflation goal clearly to the public helps keep longer-term inflation

expectations firmly anchored, thereby fostering price stability and moderate long-term

interest rates and enhancing the Committee’s ability to promote maximum employment in the

face of significanteconomic disturbances.

https://www.federalreserve.gov/monetarypolicy/files/FOMC_RulesAuthPamphlet_202001.pdf#page=4

Longer-Run Goals and Monetary Policy Strategy, adopted effective January 24, 2012; as amended

effective January 29, 2019.

Maximum Employment

The maximum level of employment is largely determined by nonmonetary factors that affect the

structure and dynamics of the labor market. These factors may change over time and may not be

directly measurable. Consequently, it would not be appropriate to specify a fixed goal for

employment; rather, the Committee’s policy decisions must be informed by assessments of the

maximum level of employment, recognizing that such assessments are necessarily uncertain and

subject to revision. The Committee considers a wide range of indicators in making these

assessments. Information about Committee participants’ estimates of the longer-run normal rates

of output growth and unemployment is published four times per year in the FOMC’s Summary of

Economic Projections. For example, in the most recent projections, the median of FOMC

participants’ estimates of the longer run normal rate of unemployment was 4.4 percent.

NOTE: There is a difference between Maximum Employment used by the Federal Reserve and the

Natural Rate of Unemployment (used in the Dual Mandate graph above) which the CBO

(Congressional Budget Office) defines the natural rate of unemployment as “the rate of

unemployment that arises from all sources other than fluctuations in demand associated with

business cycles.” Maximum employment and the natural rate of unemployment are not identical,

but do tend to move in the same direction over time.

Stable Prices

The Committee reaffirms its judgment that inflation at the rate of 2 percent, as measured by the

annual change in the price index for personal consumption expenditures, is most consistent over

the longer run with the Federal Reserve’s statutory mandate.

Moderate Long-Term Interest Rates

Communicating this inflation goal clearly to the public helps keep longer-term inflation

expectations firmly anchored, thereby fostering price stability and moderate long-term

interest rates and enhancing the Committee’s ability to promote maximum employment in the

face of significanteconomic disturbances.

https://www.federalreserve.gov/monetarypolicy/files/FOMC_RulesAuthPamphlet_202001.pdf#page=4

The idea behind creating this interactive Dual Mandate Bullseye comes The Federal Reserve Bank of Chicago's creation of

the original Dual Mandate Bullseye: https://www.chicagofed.org/research/dual-mandate/the-bullseye-chart

the original Dual Mandate Bullseye: https://www.chicagofed.org/research/dual-mandate/the-bullseye-chart

Moving forward, you must memorize the terms and abbreviations that will be used throughout this lesson

regarding the Reserves Graph. If you do not memorize these, you will have trouble understanding the Ample-

Reserves Regime.

regarding the Reserves Graph. If you do not memorize these, you will have trouble understanding the Ample-

Reserves Regime.

Three of the terms above relating to interest rates are categorized as administered rates, meaning those rates

that change because of policy decisions by the Federal Reserve. These administered rates are the DR (primary),

IOR, and interest on ON RRP. The FFR is not an administered rate, but rather a targeted rate upon which other

interest rates in the economy are based.

IOR and interest on ON RRP are the two interest rates that will be detailed throughout your learning about the

Ample-Reserves Regime. Remember that IOR today is a PRIMARY TOOL used to influence the targeted FFR.

Below are two short interactive examples on how IOR and interest on ON RRP function. Again, and most

importantly throughout this lesson, pay particular attention to these two administered rates.

that change because of policy decisions by the Federal Reserve. These administered rates are the DR (primary),

IOR, and interest on ON RRP. The FFR is not an administered rate, but rather a targeted rate upon which other

interest rates in the economy are based.

IOR and interest on ON RRP are the two interest rates that will be detailed throughout your learning about the

Ample-Reserves Regime. Remember that IOR today is a PRIMARY TOOL used to influence the targeted FFR.

Below are two short interactive examples on how IOR and interest on ON RRP function. Again, and most

importantly throughout this lesson, pay particular attention to these two administered rates.

Definition of Regime

Before getting into the NEW monetary policy entitled Ample-Reserves Regime, you must realize that the term

"regime" in recent times might have taken on a negative connotation relating to an authoritarian-type of

government or a dictatorship. However, just like many words in the dictionary, this term has several meanings.

The term "regime" in the FED's Ample-Reserves Regime means the policies of the FED are "a system or a

planned way of doing things."

Before getting into the NEW monetary policy entitled Ample-Reserves Regime, you must realize that the term

"regime" in recent times might have taken on a negative connotation relating to an authoritarian-type of

government or a dictatorship. However, just like many words in the dictionary, this term has several meanings.

The term "regime" in the FED's Ample-Reserves Regime means the policies of the FED are "a system or a

planned way of doing things."

Similar to many of the other lessons you have learned in economics, a graph is an important tool used to

describe economic concepts. Because you are going to be looking at this graph throughout the remainder of

this lesson, you will be required to label the graph correctly with the terms and abbreviations you learned in

the lesson above.

Take your cursor or finger and drag the correct terms next to their correct abbreviations.

describe economic concepts. Because you are going to be looking at this graph throughout the remainder of

this lesson, you will be required to label the graph correctly with the terms and abbreviations you learned in

the lesson above.

Take your cursor or finger and drag the correct terms next to their correct abbreviations.

Below you will be pressing the green buttons that give you a time frame with an explanation starting with

The Great Recession in 2008 all the way to 2021.

Consistent with its January 2019 Statement Regarding Monetary Policy Implementation and Balance Sheet

Normalization, the Committee reaffirms its intention to implement monetary policy in a regime in which an

ample supply of reserves ensures that control over the level of the federal funds rate and other short-term

interest rates is exercised primarily through the setting of the Federal Reserve's administered rates, and in

which active management of the supply of reserves is not required.

https://www.federalreserve.gov/monetarypolicy/policy-normalization.htm

The Great Recession in 2008 all the way to 2021.

Consistent with its January 2019 Statement Regarding Monetary Policy Implementation and Balance Sheet

Normalization, the Committee reaffirms its intention to implement monetary policy in a regime in which an

ample supply of reserves ensures that control over the level of the federal funds rate and other short-term

interest rates is exercised primarily through the setting of the Federal Reserve's administered rates, and in

which active management of the supply of reserves is not required.

https://www.federalreserve.gov/monetarypolicy/policy-normalization.htm

Looking at the graph below you are shown a situation where there are "limited or scarce reserves" which

occurred up until quantitative easing (2008 - 2014) moved the supply of reserves to a point in January 2019

when the FED officially announced its "ample-reserves regime" as the norm for monetary policy.

Notice when you drag the S (supply of reserves) along the D (demand for reserves) inside the area of "limited

reserves," this drives the FFR down.

Notice, though, when you drag the S (supply of reserves) along the D (demand for reserves) inside the area of

"ample reserves" where the D is nearly perfectly elastic, the FFR remains relatively the same.

occurred up until quantitative easing (2008 - 2014) moved the supply of reserves to a point in January 2019

when the FED officially announced its "ample-reserves regime" as the norm for monetary policy.

Notice when you drag the S (supply of reserves) along the D (demand for reserves) inside the area of "limited

reserves," this drives the FFR down.

Notice, though, when you drag the S (supply of reserves) along the D (demand for reserves) inside the area of

"ample reserves" where the D is nearly perfectly elastic, the FFR remains relatively the same.

History of How the Ample-Reserves Regime Started (2008 - 2021)

Definition of Reserves

The graph below indicates what has happened to reserves held at the Federal Reserve since 1978, my first year of

teaching economics. Take your cursor or finger along the line on the graph from 1978 - 2008 which represents total

reserves (required reserves + excess reserves starting in 1984). Notice that most of the reserves are required reserves,

as monetary policy operated in what was called a "limited or scarce reserves" framework.

In the year 2008, the U.S. economy entered into The Great Recession. Move your cursor or finger along the line on

the graph to see what happened to the amount of reserves held at the Federal Reserve when it started paying interest on

reserves in October 2008. This was the just the beginning of moving from a "limited or scarce reserves" and later into an

"ample-reserves regime."

The graph below indicates what has happened to reserves held at the Federal Reserve since 1978, my first year of

teaching economics. Take your cursor or finger along the line on the graph from 1978 - 2008 which represents total

reserves (required reserves + excess reserves starting in 1984). Notice that most of the reserves are required reserves,

as monetary policy operated in what was called a "limited or scarce reserves" framework.

In the year 2008, the U.S. economy entered into The Great Recession. Move your cursor or finger along the line on

the graph to see what happened to the amount of reserves held at the Federal Reserve when it started paying interest on

reserves in October 2008. This was the just the beginning of moving from a "limited or scarce reserves" and later into an

"ample-reserves regime."

Definition of Ample

Reserves are considered ample when the Fed's supply is at least large enough so that the equilibrium FFR (where demand equals supply) does not

materially change with movements in the quantity of reserves in the banking system. Importantly, this condition means that the Fed cannot control the

federal funds rate through routine changes in the quantity of reserves, also known as open market operations. When implementing monetary policy in an

ample-reserves regime, the Fed primarily relies on its administered interest rates (IOR and interest on ON RRP) to keep the FFR within the target range.

https://www.federalreserve.gov/econres/notes/feds-notes/implementing-monetary-policy-in-an-ample-reserves-regime-the-basics-note-1-of-3-20200701.htm#:~:text=And%20this%20is%20the%20essence,reserves%20in%20the%20banking%20system

1-of-3-20200701.htm#:~:text=And%20this%20is%20the%20essence,reserves%20in%20the%20banking%20system

Reserves are considered ample when the Fed's supply is at least large enough so that the equilibrium FFR (where demand equals supply) does not

materially change with movements in the quantity of reserves in the banking system. Importantly, this condition means that the Fed cannot control the

federal funds rate through routine changes in the quantity of reserves, also known as open market operations. When implementing monetary policy in an

ample-reserves regime, the Fed primarily relies on its administered interest rates (IOR and interest on ON RRP) to keep the FFR within the target range.

https://www.federalreserve.gov/econres/notes/feds-notes/implementing-monetary-policy-in-an-ample-reserves-regime-the-basics-note-1-of-3-20200701.htm#:~:text=And%20this%20is%20the%20essence,reserves%20in%20the%20banking%20system

1-of-3-20200701.htm#:~:text=And%20this%20is%20the%20essence,reserves%20in%20the%20banking%20system

To see how changing the administered rates (DR (primary), IOR, and interest on ON RRP) in an Ample- Reserves Regime

so as to expand or contract the economy, press the Expansionary or Contractionary buttons to the left of the graph below.

so as to expand or contract the economy, press the Expansionary or Contractionary buttons to the left of the graph below.

The views expressed on this site do not necessarily reflect those of the Federal Reserve Bank Banks or the Federal

Reserve System.

With that being said, a special thanks goes to Jane Ihrig, Senior Adviser at the Board of Governors of the Federal

Reserve System, and Scott Wolla, Economics Education Coordinator at the Federal Reserve Bank of St. Louis, for

their forward guidance in disseminating information about the new monetary policy tools in the FED's Ample-

Reserves Regime. Without their published work, economics educators throughout the United States would

continue to teach students the history of monetary policy rather than how the FED actually implements monetary

policy today.

Let’s close the gap: Revising teaching materials to reflect how the Federal Reserve implements monetary policy.

https://www.federalreserve.gov/econres/feds/files/2020092pap.pdf

Teaching the New Tools of Monetary Policy

https://www.stlouisfed.org/education/teaching-new-tools-of-monetary-policy

Reserve System.

With that being said, a special thanks goes to Jane Ihrig, Senior Adviser at the Board of Governors of the Federal

Reserve System, and Scott Wolla, Economics Education Coordinator at the Federal Reserve Bank of St. Louis, for

their forward guidance in disseminating information about the new monetary policy tools in the FED's Ample-

Reserves Regime. Without their published work, economics educators throughout the United States would

continue to teach students the history of monetary policy rather than how the FED actually implements monetary

policy today.

Let’s close the gap: Revising teaching materials to reflect how the Federal Reserve implements monetary policy.

https://www.federalreserve.gov/econres/feds/files/2020092pap.pdf

Teaching the New Tools of Monetary Policy

https://www.stlouisfed.org/education/teaching-new-tools-of-monetary-policy

In this lesson on the new tools of monetary policy, you will learn the following concepts:

*What are some of the most historical dates in regards to monetary policy?

*What is the Dual Mandate that Congress requires of the Federal Reserve?

*What is the history behind the new tools of monetary policy--Ample-Reserves Regime?

*What does the graph look like regarding Limited Reserves and Ample Reserves?

*How are monetary policy tools in an Ample Reserves Regime implemented to influence

the expansion or contraction of an economy?

*How do these new tools influence maximum employment, stable prices, and moderate

long-run term interest rates?

*What are some of the most historical dates in regards to monetary policy?

*What is the Dual Mandate that Congress requires of the Federal Reserve?

*What is the history behind the new tools of monetary policy--Ample-Reserves Regime?

*What does the graph look like regarding Limited Reserves and Ample Reserves?

*How are monetary policy tools in an Ample Reserves Regime implemented to influence

the expansion or contraction of an economy?

*How do these new tools influence maximum employment, stable prices, and moderate

long-run term interest rates?

In this lesson on monetary policy's Ample Reserves Regime you learned:

*What are some of the most historical dates in regards to monetary policy?

*What is the Dual Mandate that Congress requires of the Federal Reserve?

*What is the history behind the Ample Reserve Regime?

*What does the graph look like regarding Limited Reserves and Ample Reserves?

*How are monetary policy tools in an Ample Reserves Regime implemented to influence

the expansion or contraction of an economy?

*How do these new tools influence maximum employment, stable prices, and moderate

long-run term interest rates?

*What are some of the most historical dates in regards to monetary policy?

*What is the Dual Mandate that Congress requires of the Federal Reserve?

*What is the history behind the Ample Reserve Regime?

*What does the graph look like regarding Limited Reserves and Ample Reserves?

*How are monetary policy tools in an Ample Reserves Regime implemented to influence

the expansion or contraction of an economy?

*How do these new tools influence maximum employment, stable prices, and moderate

long-run term interest rates?

According to Investopedia, "The prime rate (prime) is the interest rate that commercial banks charge their most

creditworthy customers, generally large corporations. The prime interest rate, or prime lending rate, is largely determined

by the federal funds rate (FFR) . . . The prime rate forms the basis of or starting point for most other interest rates—

including rates for mortgages, small business loans, or personal loans."

"Generally, the prime rate is reserved for only the most qualified customers—those who pose the least amount of default

risk. Prime rates may not be available to individual borrowers as often as to larger entities, such as corporations and

particularly stable businesses."

https://www.investopedia.com/terms/p/primerate.asp

Even though the prime rate is given to mostly large entities, it relates to you because your borrowing is based upon your

credit worthiness. The more credit worthy you are, the closer your borrowing rates will be to the prime rate. The less

credit worthy you are, the farther away your borrowing rates will be to the prime rate. Throughout your lifetime, if you

start and continue to be a credit-worthy customer, you can save yourself thousands of dollars in interest payments

(mortgage, home equity loan, car loan, and so on).

Notice below that the prime rate has run about 2.5 - 3.0% above the FFR. Be a credit-worthy customer and you will receive

rates closer to the bench mark prime rate.

By your keeping track of the direction the FED wants to go with the targeted FFR, you can keep track of the direction in

which the prime rate will be heading.

creditworthy customers, generally large corporations. The prime interest rate, or prime lending rate, is largely determined

by the federal funds rate (FFR) . . . The prime rate forms the basis of or starting point for most other interest rates—

including rates for mortgages, small business loans, or personal loans."

"Generally, the prime rate is reserved for only the most qualified customers—those who pose the least amount of default

risk. Prime rates may not be available to individual borrowers as often as to larger entities, such as corporations and

particularly stable businesses."

https://www.investopedia.com/terms/p/primerate.asp

Even though the prime rate is given to mostly large entities, it relates to you because your borrowing is based upon your

credit worthiness. The more credit worthy you are, the closer your borrowing rates will be to the prime rate. The less

credit worthy you are, the farther away your borrowing rates will be to the prime rate. Throughout your lifetime, if you

start and continue to be a credit-worthy customer, you can save yourself thousands of dollars in interest payments

(mortgage, home equity loan, car loan, and so on).

Notice below that the prime rate has run about 2.5 - 3.0% above the FFR. Be a credit-worthy customer and you will receive

rates closer to the bench mark prime rate.

By your keeping track of the direction the FED wants to go with the targeted FFR, you can keep track of the direction in

which the prime rate will be heading.

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Monetary Policy (2019 - ) The Ample-Reserves Regime

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Rip out any lesson on the tools of monetary policy that include

the reserve requirement and the discount rate as the reserve

requirement is no longer a tool of monetary policy and the

discount rate is now the primary credit rate offered through the

discount window.

the reserve requirement and the discount rate as the reserve

requirement is no longer a tool of monetary policy and the

discount rate is now the primary credit rate offered through the

discount window.

March 22, 2019

Atlanta Fed president and CEO Raphael Bostic speaks at the San

Francisco Fed's Macroeconomics and Monetary Policy Conference

about the Federal Open Market Committee's recent decisions the

Committee continues to view the federal funds rate target as the

primary tool to adjust the stance of monetary policy.