| Graph 1: FOMC Target Range: Upper and Lower Limits |

| Graph 2: FOMC Target Range: Upper and Lower Limits + Federal Funds Rate (FFR) |

Inside the FOMC highlighted statement below and by touching the lines on the two graphs to the right, you will

notice that the FOMC sets a target range lower limit and upper limit shown in Graph #1 which is a range in

which it wants the Federal Funds Rate to fall in between shown in Graph #2.

notice that the FOMC sets a target range lower limit and upper limit shown in Graph #1 which is a range in

which it wants the Federal Funds Rate to fall in between shown in Graph #2.

Since December 16, 2008 the spread between the lower limit and the upper limit has been .25 percent or 25 basis points.

This is the complete graph of both the FOMC target range lower limit and

upper limits, along with the Federal Funds Rate (FFR -- the policy rate), and

the three administered rates of Primary Credit Rate (PCR), a ceiling rate;

Interest on Reserve Balances (IOR or IORB), a floor rate; and Interest on

Overnight Reverse Repurchase Agreements (ON RRP).

A couple of things to notice.

1) The Primary Credit Rate is currently at the FOMC target range upper limit.

2) The Interest on Overnight Reverse Repurchase (ON RRP) lies just above the

FOMC target range lower limit.

upper limits, along with the Federal Funds Rate (FFR -- the policy rate), and

the three administered rates of Primary Credit Rate (PCR), a ceiling rate;

Interest on Reserve Balances (IOR or IORB), a floor rate; and Interest on

Overnight Reverse Repurchase Agreements (ON RRP).

A couple of things to notice.

1) The Primary Credit Rate is currently at the FOMC target range upper limit.

2) The Interest on Overnight Reverse Repurchase (ON RRP) lies just above the

FOMC target range lower limit.

2023 Federal Open Market Committee (FOMC) Committee Members

• Jerome H. Powell, Board of Governors, Chair

• Michael S. Barr, Board of Governors

• Michelle W. Bowman, Board of Governors

• Lael Brainard, Board of Governors (resigned February 14)

• Lisa D. Cook, Board of Governors

• Philip N. Jefferson, Board of Governors

• Christopher J. Waller, Board of Governors

• John C. Williams, New York, Vice Chair

• James Bullard, St. Louis

• Susan M. Collins, Boston

• Esther L. George, Kansas City

• Loretta J. Mester, Cleveland

• Jerome H. Powell, Board of Governors, Chair

• Michael S. Barr, Board of Governors

• Michelle W. Bowman, Board of Governors

• Lael Brainard, Board of Governors (resigned February 14)

• Lisa D. Cook, Board of Governors

• Philip N. Jefferson, Board of Governors

• Christopher J. Waller, Board of Governors

• John C. Williams, New York, Vice Chair

• James Bullard, St. Louis

• Susan M. Collins, Boston

• Esther L. George, Kansas City

• Loretta J. Mester, Cleveland

2023 Board of Governors of the Federal Reserve System (FRB)

• Jerome H. Powell, Board of Governors, Chair

• Michael S. Barr, Board of Governors, Vice Chair for Supervision

• Michelle W. Bowman, Board of Governors

• Lael Brainard, Board of Governors, Vice Chair

(resigned on February 14, 2023 to become the Director of the

National Economic Council at the White House)

• Lisa D. Cook, Board of Governors

• Philip N. Jefferson, Board of Governors

• Christopher J. Waller, Board of Governors

• Jerome H. Powell, Board of Governors, Chair

• Michael S. Barr, Board of Governors, Vice Chair for Supervision

• Michelle W. Bowman, Board of Governors

• Lael Brainard, Board of Governors, Vice Chair

(resigned on February 14, 2023 to become the Director of the

National Economic Council at the White House)

• Lisa D. Cook, Board of Governors

• Philip N. Jefferson, Board of Governors

• Christopher J. Waller, Board of Governors

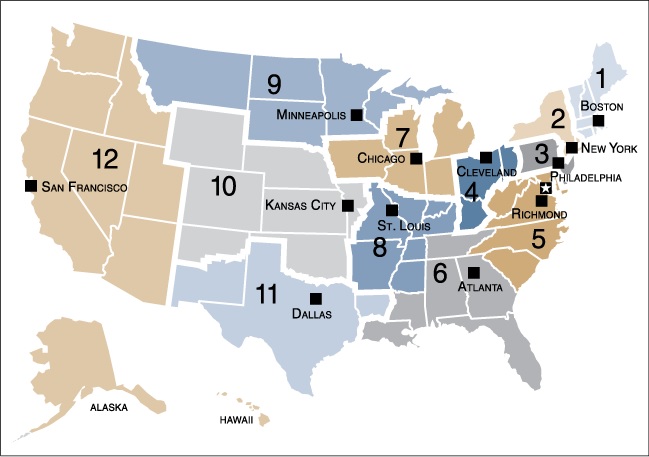

The maximum number of members who sit on the Federal Open

Market Committee (FOMC) consists of 12 members. Notice above

that the FOMC had this maximum number as of February 13:

7 members of the Board of Governors of the Federal Reserve

System as of February 13, 2023.

1 President of the Federal Reserve Bank of New York always

sits on the FOMC

4 of the remaining eleven Reserve Bank presidents, who serve

one-year terms on a rotating basis. (See district bank map below)

Market Committee (FOMC) consists of 12 members. Notice above

that the FOMC had this maximum number as of February 13:

7 members of the Board of Governors of the Federal Reserve

System as of February 13, 2023.

1 President of the Federal Reserve Bank of New York always

sits on the FOMC

4 of the remaining eleven Reserve Bank presidents, who serve

one-year terms on a rotating basis. (See district bank map below)

The maximum number of governors who sit on The Board of

Governors of the Federal Reserve is 7 governors.

Notice above as of February 13, 2023 the Board had the maximum

number.

The members of the Board of Governors of the Federal Reserve

System are nominated by the President and confirmed

by the Senate. A full term is 14 years.

The Chair and the Vice Chair of the Board, as well as the Vice

Chair for Supervision, are nominated by the President from among

the members and are confirmed by the Senate. They serve a term

of four years.

Governors of the Federal Reserve is 7 governors.

Notice above as of February 13, 2023 the Board had the maximum

number.

The members of the Board of Governors of the Federal Reserve

System are nominated by the President and confirmed

by the Senate. A full term is 14 years.

The Chair and the Vice Chair of the Board, as well as the Vice

Chair for Supervision, are nominated by the President from among

the members and are confirmed by the Senate. They serve a term

of four years.

The interest rate on reserve balances (IORB rate) and the primary

credit rate (formerly known as the discount rate) are determined

by the FRB). IORB is the primary tool for the Federal Reserve's

monetary policy.

credit rate (formerly known as the discount rate) are determined

by the FRB). IORB is the primary tool for the Federal Reserve's

monetary policy.

| The Board of Governors meet every other Monday. |

| The Federal Open Market Committee (FOMC) that meets 8 times each year. Remember this Committee also includes the members of the Board of Governors. |

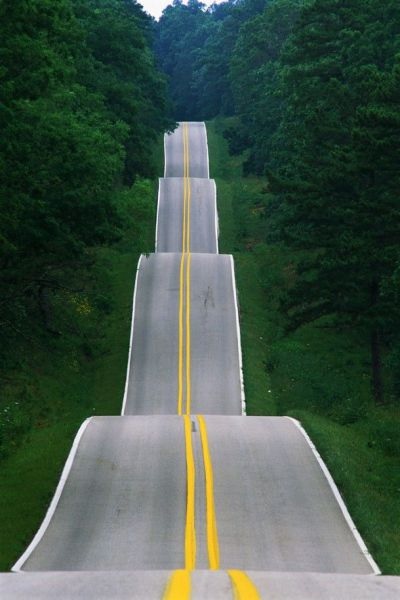

The Federal Reserve is an independent government agency. Think of monetary policy as an

agency or a business that is constructing an Economic Highway throughout the economy to set it

on a course to reach a stated goal of 2% inflation.

Let's say:

the direction of the Economic Highway is the Federal Funds Rate (FFR) known as the policy rate.

the Board Members are the members of The Board of Governors

the Group of 5 are the New York Bank President and four Federal Reserve Bank Presidents

the FOMC meeting is comprised of the Board Members + Group of 5

the Advisors are the remaining 7 Federal Reserve Bank Presidents who attend the FOMC meeting

agency or a business that is constructing an Economic Highway throughout the economy to set it

on a course to reach a stated goal of 2% inflation.

Let's say:

the direction of the Economic Highway is the Federal Funds Rate (FFR) known as the policy rate.

the Board Members are the members of The Board of Governors

the Group of 5 are the New York Bank President and four Federal Reserve Bank Presidents

the FOMC meeting is comprised of the Board Members + Group of 5

the Advisors are the remaining 7 Federal Reserve Bank Presidents who attend the FOMC meeting

At the FOMC meeting, the first order of business is to decide the direction of the Economic

Highway (the Federal Funds Rate).

Inside the FOMC meetings, the Board Members meet with the Group of 5 and together they

decide the direction of the Economic Highway. They set a target range lower limit and upper limit

so as to place a width in which the direction the Economic Highway (FFR) should fall in between.

Looking at the photo to the left, notice the white lines shown on both sides of the road are

symbolic of the lower and upper limit and the double yellow lines roughly represents the direction

of the FFR.

The second order of business is to use administered rates to help ensure an orderly flow of

operations in creating the direction of this Economic Highway in order to stay between these lines.

The administered rates are:

1) Interest on Reserve Balances (IOR or IORB), the primary tool of monetary policy

(administered by the Board Members)

2) Interest on Overnight Reverse Repurchase Agreement administered by the Board Members

and Group of 5 at the FOMC meeting. (NOT REQUIRED TO KNOW INSIDE AN ON-LEVEL

OR AN AP MACROECONOMICS COURSE).

3) Primary Credit Rate (formerly called the Discount Rate administered by the Board Members

which approves the request to establish this rate submitted by the Advisors District Banks'

Boards.)

Highway (the Federal Funds Rate).

Inside the FOMC meetings, the Board Members meet with the Group of 5 and together they

decide the direction of the Economic Highway. They set a target range lower limit and upper limit

so as to place a width in which the direction the Economic Highway (FFR) should fall in between.

Looking at the photo to the left, notice the white lines shown on both sides of the road are

symbolic of the lower and upper limit and the double yellow lines roughly represents the direction

of the FFR.

The second order of business is to use administered rates to help ensure an orderly flow of

operations in creating the direction of this Economic Highway in order to stay between these lines.

The administered rates are:

1) Interest on Reserve Balances (IOR or IORB), the primary tool of monetary policy

(administered by the Board Members)

2) Interest on Overnight Reverse Repurchase Agreement administered by the Board Members

and Group of 5 at the FOMC meeting. (NOT REQUIRED TO KNOW INSIDE AN ON-LEVEL

OR AN AP MACROECONOMICS COURSE).

3) Primary Credit Rate (formerly called the Discount Rate administered by the Board Members

which approves the request to establish this rate submitted by the Advisors District Banks'

Boards.)

1) The FOMC sets the target range lower limit

and upper limit for the Federal Funds Rate

(FFR), a policy rate.

and upper limit for the Federal Funds Rate

(FFR), a policy rate.

2) With this information, the Board of

Governors sets an administered rate,

Interest on Reserve Balances (IOR or

IORB), the primary tool of monetary

policy to guide the FFR in a similar

direction. The IOR or IORB is a

"floor rate."

Governors sets an administered rate,

Interest on Reserve Balances (IOR or

IORB), the primary tool of monetary

policy to guide the FFR in a similar

direction. The IOR or IORB is a

"floor rate."

2) The FOMC directs the New York Desk to

maintain the Federal Funds Rate (FFR)

within the target range lower limit and

upper limit set by the committee.

maintain the Federal Funds Rate (FFR)

within the target range lower limit and

upper limit set by the committee.

2) The FOMC directs the New York Desk to

conduct Overnight Reverse Repurchase

Agreement operations at an offering

rate entitled, "Interest on Overnight

Repurchase Agreement" (ON RRP).

The interest on ON RRP is a "sub-floor

rate."

NOTE: HIGH SCHOOL STUDENTS

DO NOT HAVE TO KNOW THIS RATE,

BUT IS NOT IMPOSSIBLE FOR THEM

TO UNDERSTAND. ON THE SLIDE SHOW

LOCATED TO THE RIGHT, CLICK ON

THE STEPS AND THEN CLICK THE

NEXT BUTTONS AND LEARN

ABOUT IORB AND INTEREST ON ON RRP.

conduct Overnight Reverse Repurchase

Agreement operations at an offering

rate entitled, "Interest on Overnight

Repurchase Agreement" (ON RRP).

The interest on ON RRP is a "sub-floor

rate."

NOTE: HIGH SCHOOL STUDENTS

DO NOT HAVE TO KNOW THIS RATE,

BUT IS NOT IMPOSSIBLE FOR THEM

TO UNDERSTAND. ON THE SLIDE SHOW

LOCATED TO THE RIGHT, CLICK ON

THE STEPS AND THEN CLICK THE

NEXT BUTTONS AND LEARN

ABOUT IORB AND INTEREST ON ON RRP.

3) The remaining Presidents of the 12 District

Bank members who are not sitting on

the FOMC but are in attendance during

the FOMC meeting give the Board of

Governors the request from their district

boards on the establishment of the Primary

Credit Rate (formerly know as the Discount

Rate). Since March 2020, the PCR or DR is

a "ceiling rate" has been identical to the

target range upper limit set by the FOMC.

Bank members who are not sitting on

the FOMC but are in attendance during

the FOMC meeting give the Board of

Governors the request from their district

boards on the establishment of the Primary

Credit Rate (formerly know as the Discount

Rate). Since March 2020, the PCR or DR is

a "ceiling rate" has been identical to the

target range upper limit set by the FOMC.

3) With this information, the Board of

Governors sets an administered rate,

Primary Credit Rate (PCR or DR). The

PCR or DR is a "ceiling rate."

Governors sets an administered rate,

Primary Credit Rate (PCR or DR). The

PCR or DR is a "ceiling rate."

| An Analogy on How the Federal Open Market Committee (FOMC) directs Monetary Policy |

| The Economic Highway |

of Monetary Policy

| Looking at this in Reality -- Observe the Two Documents Below from the FOMC Meeting on July 26, 2023 |

Before reading the FOMC Press Release below, notice the official written narrative is highlighted in yellow that describes the implementation of the administered rates

and highlighted in red which describes the lower and upper limits of the target range for the policy rate, the Federal Funds Rate (FFR).

and highlighted in red which describes the lower and upper limits of the target range for the policy rate, the Federal Funds Rate (FFR).

The notes down the left margin that are inserted independently of the Press Release are place there for students knowledge of what they should know about

Ample Reserves.

Ample Reserves.

| Document #1: Federal Reserve FOMC Statement |

| Document #2: Press Release -- Decisions Regarding Monetary Policy Implementation |

| A Condensed Version of Understanding the FOMC Statement and Press Release |

Steps 1, 2, and 3 of the FOMC Meetings

| Using FRED Graphs to Explain the FOMC Statement and Press Release |

A lesson in economics without a graph is like a day without sunshine. Let's take the information from the FOMC Statement and Press Release

above and place this information to the right of FRED graphs that create a graphical representation of the narrative. Use your cursor or finger and

touch the lines on the FRED graphs to get current data located on the graph.

above and place this information to the right of FRED graphs that create a graphical representation of the narrative. Use your cursor or finger and

touch the lines on the FRED graphs to get current data located on the graph.

In July of 2023, the target range lower limit and upper limit for the

Federal Funds Rate (FFR) were raised to 5.25% to 5.5% respectively.

In June of 2023, the target range lower limit and upper limit for the

Federal Funds Rate (FFR) stood at 5.0% to 5.25% respectively.

This is an increase of .25% or 25 basis points for both the lower limit

and upper limit.

Federal Funds Rate (FFR) were raised to 5.25% to 5.5% respectively.

In June of 2023, the target range lower limit and upper limit for the

Federal Funds Rate (FFR) stood at 5.0% to 5.25% respectively.

This is an increase of .25% or 25 basis points for both the lower limit

and upper limit.

The primary tool of monetary policy is paying Interest paid on Reserve Balances (IOR or IORB).

In July of 2023, the Board of Governors voted unanimously to raise the Interest paid on

Reserve Balances (IOR or IORB) to 5.4%.

In June of 2023, the Interest paid on Reserve Balances (IOR or IORB) stood at 5.15%.

This is an increase of .25% or 25 basis points.

Paying interest on reserve balances (IOR or IORB) is the primary tool of monetary policy

because it allows the FED to place a floor on the Federal Funds Rate (FFR), since

depository institutions have little incentive to lend in the overnight interbank Federal

Funds market at rates below the interest rate on reserve balances (IOR or IORB).

When the FED raises the administered Interest paid on Reserve Balances (IOR or IORB),

this pulls the Federal Funds Rate up.

In July of 2023, the Board of Governors voted unanimously to raise the Interest paid on

Reserve Balances (IOR or IORB) to 5.4%.

In June of 2023, the Interest paid on Reserve Balances (IOR or IORB) stood at 5.15%.

This is an increase of .25% or 25 basis points.

Paying interest on reserve balances (IOR or IORB) is the primary tool of monetary policy

because it allows the FED to place a floor on the Federal Funds Rate (FFR), since

depository institutions have little incentive to lend in the overnight interbank Federal

Funds market at rates below the interest rate on reserve balances (IOR or IORB).

When the FED raises the administered Interest paid on Reserve Balances (IOR or IORB),

this pulls the Federal Funds Rate up.

In July of 2023, the FOMC conducted Overnight Repurchase

Agreement Operations (ON RRP) at an offering interest rate

of 5.3%, up from 5.05% in June of 2023.

Interest on Overnight Repurchase Agreement is a "sub-floor"

interest rate.

NOTE: HIGH SCHOOL ECONOMICS STUDENTS DO NOT

HAVE TO KNOW THIS ADMINISTRATED RATE, EVEN THOUGH

IN THE LESSON BELOW ONE CAN SEE THAT THIS CONCEPT

IS NOT TOO DIFFICULT TO UNDERSTAND THE BASICS OF

THIS RATE.

Agreement Operations (ON RRP) at an offering interest rate

of 5.3%, up from 5.05% in June of 2023.

Interest on Overnight Repurchase Agreement is a "sub-floor"

interest rate.

NOTE: HIGH SCHOOL ECONOMICS STUDENTS DO NOT

HAVE TO KNOW THIS ADMINISTRATED RATE, EVEN THOUGH

IN THE LESSON BELOW ONE CAN SEE THAT THIS CONCEPT

IS NOT TOO DIFFICULT TO UNDERSTAND THE BASICS OF

THIS RATE.

| FOMC Statement |

| FOMC Press Release |

The remaining Presidents of the 12 District Bank members

who are not sitting on the FOMC but are in attendance during

the FOMC meeting give the Board of Governors the request

from their district boards on the establishment of the Primary

Credit Rate (formerly know as the Discount Rate). The Board

of Governors approved a .25% point increase or 25 basis

points.

Since March 16, 2020, the PCR or DR is a "ceiling rate" has

been identical to the target range upper limit set by the FOMC.

who are not sitting on the FOMC but are in attendance during

the FOMC meeting give the Board of Governors the request

from their district boards on the establishment of the Primary

Credit Rate (formerly know as the Discount Rate). The Board

of Governors approved a .25% point increase or 25 basis

points.

Since March 16, 2020, the PCR or DR is a "ceiling rate" has

been identical to the target range upper limit set by the FOMC.

12 Federal Reserve District Bank Presidents

The New York Federal Reserve District Bank President and

4 Federal Reserve District Bank Presidents sit on the

Federal Open Market Committee (FOMC)

The remaining 7 Federal Reserve Bank Presidents attend

the FOMC meetings and bring their district board reports

to help advise The Board of Governors on the

Primary Credit Rate (formerly entitled the Discount Rate)

that should be administered. The Board of Governors

then makes the final decision on this rate.

The New York Federal Reserve District Bank President and

4 Federal Reserve District Bank Presidents sit on the

Federal Open Market Committee (FOMC)

The remaining 7 Federal Reserve Bank Presidents attend

the FOMC meetings and bring their district board reports

to help advise The Board of Governors on the

Primary Credit Rate (formerly entitled the Discount Rate)

that should be administered. The Board of Governors

then makes the final decision on this rate.

| The Federal Open Market Committee (FOMC), the Board of Governors, and the 12 District Bank Presidents |

| The Economic Highway |

| Lesson #1 |

| Lesson #2 |

| Lesson #3 |

| Lesson #4 |

- - - - - - - - - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - - - - - - - - -

The information below is from the FOMC Statement (Step 1) and the Press Release (Steps 2 and 3) shown in the two documents in Lesson 2 above.

DISCLAIMER: The following terms inside this website are all registered trademarks -- College Board®, AP®, FRED®, Federal Reserve Bank of St.

Louis®. This website uses these terms inside this website that is not intended for commercial advantage or private monetary compensation.

These trademark entities are not affiliated with and do not endorse Steven Reff or Reffonomics.com.

Louis®. This website uses these terms inside this website that is not intended for commercial advantage or private monetary compensation.

These trademark entities are not affiliated with and do not endorse Steven Reff or Reffonomics.com.

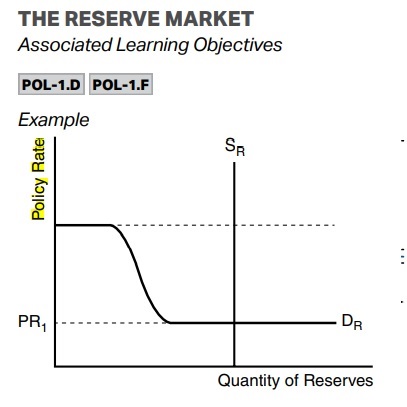

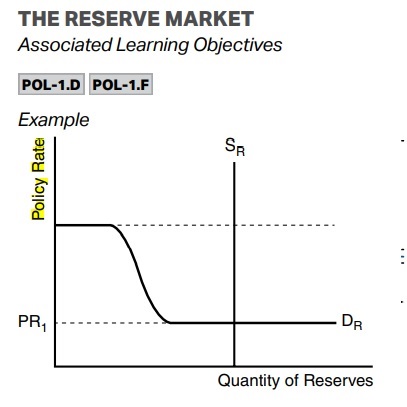

| Ample Reserves -- Challenges with The College Board Graph and the FED Graph |

| Graph Lesson #1 |

- - - - - - - - - - - - - - - - - - - - - - - - - - - -

Below is a discussion about The College Board Graph located below on the left and the two FED graphs located below on the right.

1) Notice the y axis is labeled Policy Rate.

1) Notice the y axis is labeled Federal Funds Rate.

2) Notice Interest on Reserve Balances (IOR

or IORB) is NOT shown on the graph, yet it is

the primary tool of monetary policy.

or IORB) is NOT shown on the graph, yet it is

the primary tool of monetary policy.

2) Notice the y axis has the three administered

rates, but does not have the policy rate (FFR)

labeled along the y axis. The label at the top

should be Interest Rates (both policy and

administered)

rates, but does not have the policy rate (FFR)

labeled along the y axis. The label at the top

should be Interest Rates (both policy and

administered)

3) Notice the administered rate entitled IOER

(interest on excess reserves). As of July 2021,

interest on required reserves (RR) and interest on

excess reserves (ER) were replaced by a single

rate -- Interest on Reserve Balances (IOR or IORB),

the primary tool of monetary policy.

(interest on excess reserves). As of July 2021,

interest on required reserves (RR) and interest on

excess reserves (ER) were replaced by a single

rate -- Interest on Reserve Balances (IOR or IORB),

the primary tool of monetary policy.

"Before the Financial Crisis of 2007-09,

the Fed implemented monetary policy

with limited reserves in the banking

system and relied on open market

operations as its key tool. Today, the

Fed implements monetary policy with

ample reserves and relies on one of its

administered rates. Interest on reserve

balances (IORB), with the associated

IORB rate, is the primary tool.."

--The FED's New Monetary Policy

Tools--

By looking at the two FED graphs

above and using your cursor or finger

on the FRED graph of bank reserves

to the right, notice the $15 billion with

limited or scarce reserves occurred

on July 2, 2008 and in the graph next

to it, the $1.6 trillion of ample reserves

takes place on June 1, 2011.

the Fed implemented monetary policy

with limited reserves in the banking

system and relied on open market

operations as its key tool. Today, the

Fed implements monetary policy with

ample reserves and relies on one of its

administered rates. Interest on reserve

balances (IORB), with the associated

IORB rate, is the primary tool.."

--The FED's New Monetary Policy

Tools--

By looking at the two FED graphs

above and using your cursor or finger

on the FRED graph of bank reserves

to the right, notice the $15 billion with

limited or scarce reserves occurred

on July 2, 2008 and in the graph next

to it, the $1.6 trillion of ample reserves

takes place on June 1, 2011.

| Ample Reserves -- A Better Graph that Solves the Challenges of the Graphs Above |

| Graph Lesson #2 |

| The FED uses Contractionary Monetary Policy to Slow the Economy The FED uses Expansionary Monetary Policy to Speed Up the Economy |

| How Does Monetary Policy Affect Short-Term and Long-Term Interest Rates? |

Notice on the two top graphs below the FED has been using contractionary monetary policy by raising the Interest on Reserve Balances

(IOR or IORB). On the two bottom graphs you can see because of the FED's action, short-term interest rates and long-term interest

rates in the economy have started to rise. An increase in short-term and long-term interest rates has a propensity to decrease

consumptiion and investment in the economy which causes a decrease in aggregate demand.

(IOR or IORB). On the two bottom graphs you can see because of the FED's action, short-term interest rates and long-term interest

rates in the economy have started to rise. An increase in short-term and long-term interest rates has a propensity to decrease

consumptiion and investment in the economy which causes a decrease in aggregate demand.

Short-term Interest Rates

Long-term Interest Rates

Credit Card Rates, 48-Month Auto Loan Rates, and Prime Rate

30-Year Fixed Mortgage Rate

Notice on the graph above, the portion that represents

the limited reserves is shorter and less pronounced as

it is shown on The College Board graph to the right.

The dashed line in the graph above is labeled correctly

as the PRC or DR, yet, the College Board graph on the

right does not label this dashed line.

The other change on the graph above is the spread

between the primary credit rate (PCR) and the interest

on reserve balances (IOR or IORB) has been 10 basis

points since July 29, 2021. Since the IOR or IORB

(which is NOT shown on the graph to the right) is only

slightly higher than the PR (policy rate) that is shown on

the graph, the current 10 basis-point spread is not

shown correctly.

the limited reserves is shorter and less pronounced as

it is shown on The College Board graph to the right.

The dashed line in the graph above is labeled correctly

as the PRC or DR, yet, the College Board graph on the

right does not label this dashed line.

The other change on the graph above is the spread

between the primary credit rate (PCR) and the interest

on reserve balances (IOR or IORB) has been 10 basis

points since July 29, 2021. Since the IOR or IORB

(which is NOT shown on the graph to the right) is only

slightly higher than the PR (policy rate) that is shown on

the graph, the current 10 basis-point spread is not

shown correctly.

In 2019 the Federal Reserve's Statement Regarding

Monetary Policy Implementation and Balance Sheet

Normalization stated "The Committee intends to

continue to implement monetary policy in a regime in

which an ample supply of reserves ensures the control

over the level of the federal funds rate and other

short-term interest rates is exercised primarily through

the setting of the Federal Reserve's administered rates,

and in which active management of the supply of

reserves is not required."

". . . the active management of the supply of reserves

is not required" which means required reserves (RR) and

excess reserves (ER) that used to be on commercial

banks' balance sheets no longer are relevant moving

forward in regards to monetary policy." This is why the

interactive Reffonomics graph above to the left has a

shorter and less pronounce section that represents

limited reserves.

Monetary Policy Implementation and Balance Sheet

Normalization stated "The Committee intends to

continue to implement monetary policy in a regime in

which an ample supply of reserves ensures the control

over the level of the federal funds rate and other

short-term interest rates is exercised primarily through

the setting of the Federal Reserve's administered rates,

and in which active management of the supply of

reserves is not required."

". . . the active management of the supply of reserves

is not required" which means required reserves (RR) and

excess reserves (ER) that used to be on commercial

banks' balance sheets no longer are relevant moving

forward in regards to monetary policy." This is why the

interactive Reffonomics graph above to the left has a

shorter and less pronounce section that represents

limited reserves.

- - - - - - - - - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - - - - - - - - -

| Flow Charting Ample Reserves with an Ample Reserves Graph and ASAD Graph |

- - - - - - - - - - - - - - - - - - - - - - - - - - - -

When you open the links below, you will see a side-by-side interactive Ample Reserves Graph and an ASAD graph. Underneath these

graphs is an interactive flow chart. After playing with the graphs and flow chart, if students can take out a piece of paper and draw

these two graphs from scratch and explain what happens using a flow chart, they should be able to succeed on any questions regarding

Ample Reserves that is found on the May exam.

graphs is an interactive flow chart. After playing with the graphs and flow chart, if students can take out a piece of paper and draw

these two graphs from scratch and explain what happens using a flow chart, they should be able to succeed on any questions regarding

Ample Reserves that is found on the May exam.

| Interactive Lessons (Graphs and Flow Charting) |

The Rules on How to Use the Reffonomics Baseball Game:

| Interactive Lessons (Graphs and Flow Charting) |

| Reffonomics Baseball -- Ample Reserves Regime |

The Reffonomics Baseball Game uses the Federal Reserve of St. Louis more complex graph, rather than The College Board Graph.

Contractionary Monetary Policy Flow Chart (Using The College Board graph with PCR or DR, IOR and FFR added to the graph)

Expansionary Monetary Policy Flow Chart (Using The College Board graph with PCR or DR, IOR, and FFR added to the graph)

- - - - - - - - - - - - - - - - - - - - - - - - - - - -

October 23, 2020

Without the knowledge received from reading the two articles (shown in the two links below) written by Jane Ihrig, Senior Advisor at the

Federal Reserve Board, and Scott Wolla, Economic Education Officer at Federal Reserve Bank of St. Louis, this website would never

have been created.

Federal Reserve Board, and Scott Wolla, Economic Education Officer at Federal Reserve Bank of St. Louis, this website would never

have been created.

After reading the information on this website below regarding teaching ample reserves by using the FOMC Statement, the Press Release,

FRED graphs, and interactive graphs, come back here and open this link that has all of the lesson plans created by the Federal Reserve

Bank of St. Louis Economics Education Program:

FRED graphs, and interactive graphs, come back here and open this link that has all of the lesson plans created by the Federal Reserve

Bank of St. Louis Economics Education Program:

May 2022

| Ample Reserves Lessons Using FOMC Meeting Statement and Press Release July 26, 2023 FOMC Meeting by Steven Reff |

- - - - - - - - - - - - - - - - - - - - - - - - - - - -

Students must have an understanding of the three entities involved in setting the direction of monetary policy (FOMC, Board of Governors, and the

12 District Bank Presidents) before learning about the FED's Ample Reserves policies.

12 District Bank Presidents) before learning about the FED's Ample Reserves policies.

- - - - - - - - - - - - - - - - - - - - - - - - - - - -

| Special Acknowledgements |

Know the vocabulary about Federal Reserve interest rates:

Interest on Reserve Balances (IORB or IOR-- the primary tool of monetary policy): The Federal Reserve pays interest to financial institutions

to hold their reserves with the Federal Reserve.

to hold their reserves with the Federal Reserve.

Interest on Overnight Repurchase Agreement: This is an agreement between the FED and its registered counter parties.

NOTE: Students are NOT required to know this information for the May exam, but this concept will be explained later on this website.

NOTE: Students are NOT required to know this information for the May exam, but this concept will be explained later on this website.

Effective Federal Funds Rate (FFR) -- This is the rate that depository institutions charge other depository institutions for borrowing money

overnight.

overnight.

Primary Credit Rate (PCR formerly entitled the Discount Rate (DR)): This is a lending program that serves as the principal safety valve

for ensuring adequate liquidity in the banking system. If financial institutions need emergency funding, they can borrow from the

Federal Reserve at the Primary Credit Rate.

for ensuring adequate liquidity in the banking system. If financial institutions need emergency funding, they can borrow from the

Federal Reserve at the Primary Credit Rate.

The Policy Rate:

The 3 Administered Rate:

Idea behind this interactive slide show comes from Jane Ihrig's and Scott Wolla's writings.

The Federal Reserve encourages depository institutions to turn to the discount window to help meet demands for credit from

households and businesses at this time. In support of this goal, the Board today announced that it will lower the primary credit rate

by 150 basis points to 0.25 percent, effective March 16, 2020. This reduction in the primary credit rate reflects both the 100 basis

point reduction in the target range for the federal funds rate and a 50 basis point narrowing in the primary credit rate relative to the

top of the target range. Narrowing the spread of the primary credit rate relative to the general level of overnight interest rates

should help encourage more active use of the window by depository institutions to meet unexpected funding needs. To further

enhance the role of the discount window as a tool for banks in addressing potential funding pressures, the Board also today

announced that depository institutions may borrow from the discount window for periods as long as 90 days, prepayable and

renewable by the borrower on a daily basis.

households and businesses at this time. In support of this goal, the Board today announced that it will lower the primary credit rate

by 150 basis points to 0.25 percent, effective March 16, 2020. This reduction in the primary credit rate reflects both the 100 basis

point reduction in the target range for the federal funds rate and a 50 basis point narrowing in the primary credit rate relative to the

top of the target range. Narrowing the spread of the primary credit rate relative to the general level of overnight interest rates

should help encourage more active use of the window by depository institutions to meet unexpected funding needs. To further

enhance the role of the discount window as a tool for banks in addressing potential funding pressures, the Board also today

announced that depository institutions may borrow from the discount window for periods as long as 90 days, prepayable and

renewable by the borrower on a daily basis.

4) Notice The College Board graph and the FED graphs both shows limited reserves on one graph and compares those reserve with

ample reserves on the other graph. The College Board still requires students to know about limited reserves with a possible reason

being that not all countries' central banks have an ample reserves policy. The FED graphs compare limited reserves vs. ample

reserves to possibly describe a historical perspective moving from monetary policy where reserves were kept in commercial banks

as Required Reserves (RR) and Excess Reserves (ER).

ample reserves on the other graph. The College Board still requires students to know about limited reserves with a possible reason

being that not all countries' central banks have an ample reserves policy. The FED graphs compare limited reserves vs. ample

reserves to possibly describe a historical perspective moving from monetary policy where reserves were kept in commercial banks

as Required Reserves (RR) and Excess Reserves (ER).

An FEE.org Fireside Chat Lesson that Describes ALL the MAJOR Changes in Monetary Policy Using FRED graphs

| Historical Changes in Monetary Policy Since 2003 |