The Financial Services Regulatory Relief Act of 2006 authorized

the Federal Reserve Banks to pay interest on balances held by or on

behalf of eligible institutions in master accounts at Reserve Banks,

subject to regulations of the Board of Governors, effective October 1,

2011. The effective date of this authority was advanced to October 1,

2008, by the Emergency Economic Stabilization Act of 2008.

2008 - 2014: From the Federal Reserve Bank in New York

https://www.newyorkfed.org/markets/pomo_landing.html

Historically, the New York Desk purchased securities outright in

the secondary market as needed to keep pace with the amount of

currency in circulation—traditionally the Federal Reserve's largest

liability—which increased over time as the economy grew.

Between 2008 and 2014, the FOMC directed the Desk to change

the size or the composition of the SOMA's Treasury portfolio in

order to influence longer-term interest rates and support broader

financial conditions through its large-scale asset purchase

programs.

This was entitled Quantitative Easing.

the Federal Reserve Banks to pay interest on balances held by or on

behalf of eligible institutions in master accounts at Reserve Banks,

subject to regulations of the Board of Governors, effective October 1,

2011. The effective date of this authority was advanced to October 1,

2008, by the Emergency Economic Stabilization Act of 2008.

2008 - 2014: From the Federal Reserve Bank in New York

https://www.newyorkfed.org/markets/pomo_landing.html

Historically, the New York Desk purchased securities outright in

the secondary market as needed to keep pace with the amount of

currency in circulation—traditionally the Federal Reserve's largest

liability—which increased over time as the economy grew.

Between 2008 and 2014, the FOMC directed the Desk to change

the size or the composition of the SOMA's Treasury portfolio in

order to influence longer-term interest rates and support broader

financial conditions through its large-scale asset purchase

programs.

This was entitled Quantitative Easing.

| Fireside Chat 5 |

| MACRO -- Unit 4, Topic 4.6: Monetary Policy |

Forward Guidance and the May Exam!

Carry out an in-class simulation of

open-market operations in an economy

with limited reserves to give students a

frame of reference for how T-accounts

record lending activity while also

observing the effects of central bank

purchases and sales of securities.

Have students take on the role of

banks and give them a blank

T-account and set of assets, typically

securities and cash (deposits). With

you acting as the central bank,

introduce policy actions that require

the “banks” to adjust their

T-accounts accordingly. Debrief the

experience with students to ensure that

connections are made to the concepts

being studied.

open-market operations in an economy

with limited reserves to give students a

frame of reference for how T-accounts

record lending activity while also

observing the effects of central bank

purchases and sales of securities.

Have students take on the role of

banks and give them a blank

T-account and set of assets, typically

securities and cash (deposits). With

you acting as the central bank,

introduce policy actions that require

the “banks” to adjust their

T-accounts accordingly. Debrief the

experience with students to ensure that

connections are made to the concepts

being studied.

| What Can Students Expect to See on the May Exam? |

Arbitrage is not mentioned inside the Macroeconomics CED.

Overnight Reverse Repurchase Agreements with Primary Dealers--

Interest on ON-RRP is NOT mentioned inside the Macroeconomics

CED.

The tools of monetary policy may include the central bank’s

discount rate and other administered interest rates (e.g., interest

on reserves)

Overnight Reverse Repurchase Agreements with Primary Dealers--

Interest on ON-RRP is NOT mentioned inside the Macroeconomics

CED.

The tools of monetary policy may include the central bank’s

discount rate and other administered interest rates (e.g., interest

on reserves)

| MICRO: Unit 4: Topic 4.6 Monetary Policy (2 class periods) |

| Steven Reff (3 minutes): Ample Reserve Activities to Use (Inside or Outside the Classroom) |

When reserves are limited (or scarce), relatively

small increases or decreases in the supply of

reserves shifts the supply curve right (left) and

results in a lower (higher) FFR as follows:

To raise the FFR, the Fed decreases the supply of

reserves by selling U.S. Treasury securities in the

open market. The decrease in reserves shifts the

supply curve left, resulting in a higher FFR.

To lower the FFR, the Fed increases the supply of

reserves by buying U.S. Treasury securities in the

open market. The increase in reserves shifts the

supply curve right, resulting in a lower FFR.

small increases or decreases in the supply of

reserves shifts the supply curve right (left) and

results in a lower (higher) FFR as follows:

To raise the FFR, the Fed decreases the supply of

reserves by selling U.S. Treasury securities in the

open market. The decrease in reserves shifts the

supply curve left, resulting in a higher FFR.

To lower the FFR, the Fed increases the supply of

reserves by buying U.S. Treasury securities in the

open market. The increase in reserves shifts the

supply curve right, resulting in a lower FFR.

Students are STILL expected to know

this graph for the May Exam.

this graph for the May Exam.

Students are expected to know

this graph of Ample Reserves for

the May Exam.

this graph of Ample Reserves for

the May Exam.

Fill in the following information:

Email Address

First Name Last Name

Check Box -- I agree to the Terms of Use

Click the Sign up Button

Email Address

First Name Last Name

Check Box -- I agree to the Terms of Use

Click the Sign up Button

Notice the labeling on both the Y and the X axes are different for these two graphs.

Complete your account setup to get started.

Click the Complete setup Button.

From now on you can sign in at:

Online.reffonomics.com

To quickly get to the Principles of

Microeconomics Course Curriculum,

you can sign in by clicking on this link:

Reffonomics: Principles of Microeconomics

Click the Complete setup Button.

From now on you can sign in at:

Online.reffonomics.com

To quickly get to the Principles of

Microeconomics Course Curriculum,

you can sign in by clicking on this link:

Reffonomics: Principles of Microeconomics

When the central bank conducts an

open-market purchase (sale) in an

economy with limited reserves, the

effect on the money supply (MS) is

greater than the effect on the

monetary base (M0) because of the

money multiplier (1/RR).

The monetary base (often labeled as

M0 or MB) includes currency in

circulation and bank reserves.

open-market purchase (sale) in an

economy with limited reserves, the

effect on the money supply (MS) is

greater than the effect on the

monetary base (M0) because of the

money multiplier (1/RR).

The monetary base (often labeled as

M0 or MB) includes currency in

circulation and bank reserves.

A Balance Sheet is different than a

T-Account.

A T-account is used to track specific

transactions using double entry

accounting with the left side being a

debit and the right side being a credit,

while the balance sheet is a summary

of a company's overall financial

position with Assets and Liabilities

at a specific point in time.

T-Account.

A T-account is used to track specific

transactions using double entry

accounting with the left side being a

debit and the right side being a credit,

while the balance sheet is a summary

of a company's overall financial

position with Assets and Liabilities

at a specific point in time.

| Reff -- Cell Phone Graphing |

| Current Event on Ample Reserves Regime (June 15, 2022): |

Money Market Graph from the 2022 CED

Ample Reserves Market from the 2022 CED

| Reffonomics Baseball Ample Reserves Regime |

Limited Reserves Market from the FED (Scott Wolla)

| eTextbook Lesson posted on April 8, 2021: |

Ample Reserves Market from the FED (Scott Wolla)

https://www.stlouisfed.org/-/media/project/frbstl/stlouisfed/blog/2020

/august/reservessupply-graph01.gif

/august/reservessupply-graph01.gif

None of this is made possible without my standing on the shoulders of giants -- The College Board®,

Scott Wolla at the Federal Reserve of St. Louis, Jane Ihrig, Senior Economist at the FED, and the

websites by FRED® from the Federal Reserve of St. Louis. None of these individuals and entities

endorse this Fireside Chat. The use of their outstanding resources hopefully only enhances the

teaching of their great work.

Scott Wolla at the Federal Reserve of St. Louis, Jane Ihrig, Senior Economist at the FED, and the

websites by FRED® from the Federal Reserve of St. Louis. None of these individuals and entities

endorse this Fireside Chat. The use of their outstanding resources hopefully only enhances the

teaching of their great work.

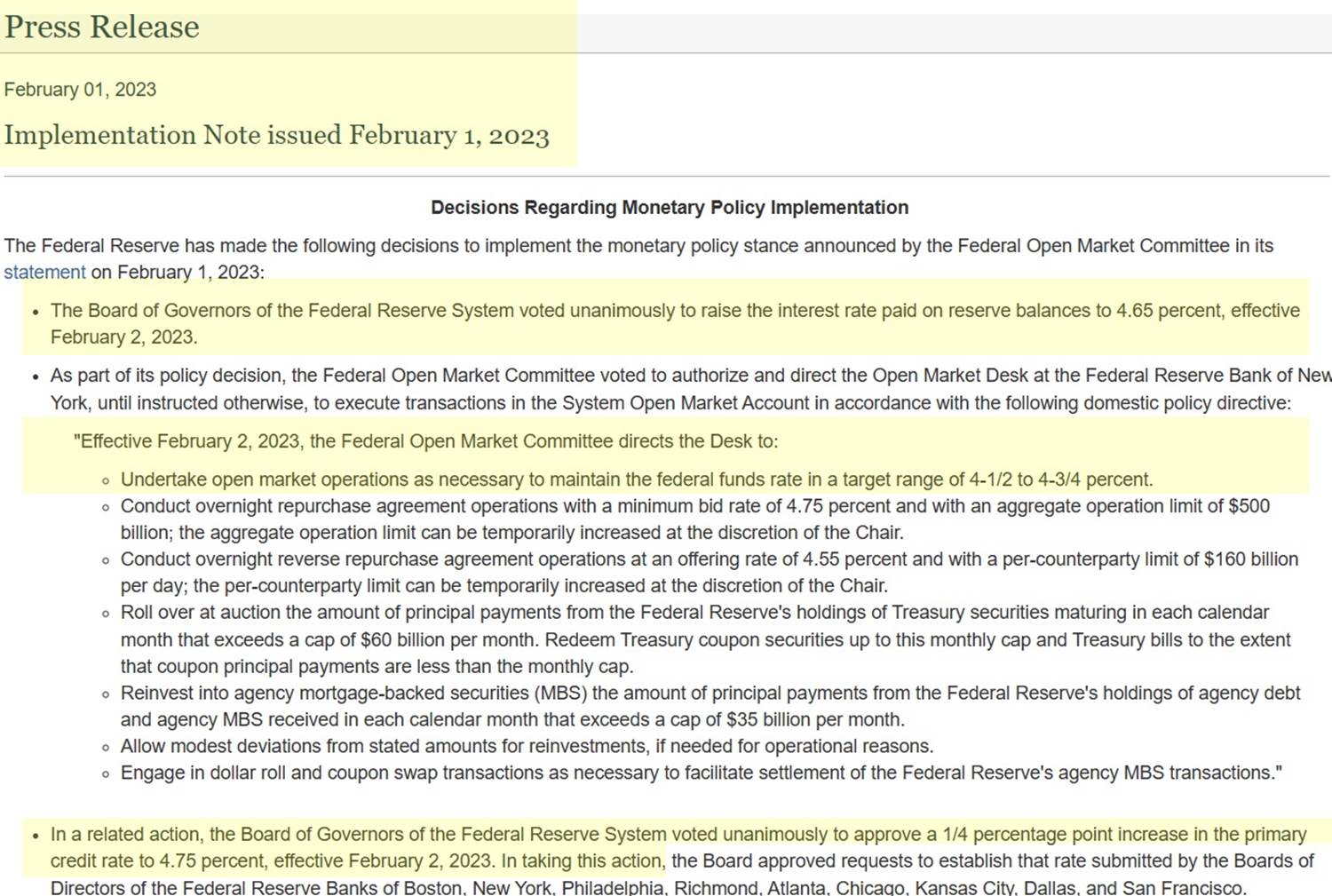

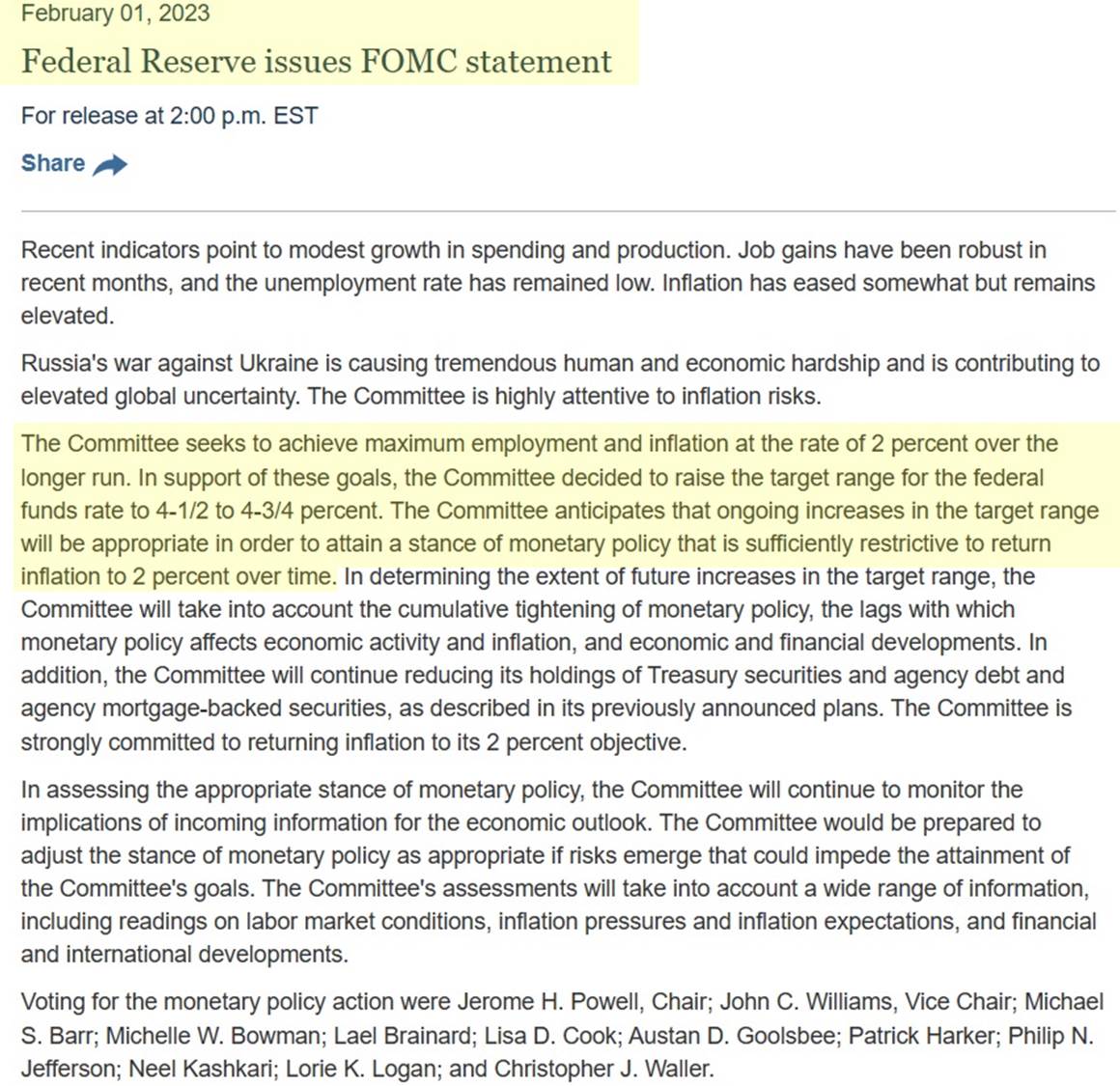

| FOMC Press Conference with Chairman Jerome Powell on February 1, 2023 at 2 p.m. Eastern Time |

| The Present (February 1, 2023 - February 14, 2023) |

While there’s no exact definition of supercore, Mr. Powell and other senior Fed officials

have been looking at core inflation in three buckets: core goods, housing services, and

core services with housing removed. The third bucket is what’s been getting all the

attention and is sometimes referred to as supercore.

have been looking at core inflation in three buckets: core goods, housing services, and

core services with housing removed. The third bucket is what’s been getting all the

attention and is sometimes referred to as supercore.

| February 1, 2023 SUPERCORE INFLATION!! |

Back in November 2022, Jerome Powell's gave his official notice of looking at supercore inflation

in a speech at the Brookings Institute in Washington, D.C when he stated, "Despite the tighter

policy and slower growth over the past year, we have not seen clear progress on slowing inflation.

To assess what it will take to get inflation down, it is useful to break core inflation into three

component categories: core goods inflation, housing services inflation, and inflation in core

services other than housing."

in a speech at the Brookings Institute in Washington, D.C when he stated, "Despite the tighter

policy and slower growth over the past year, we have not seen clear progress on slowing inflation.

To assess what it will take to get inflation down, it is useful to break core inflation into three

component categories: core goods inflation, housing services inflation, and inflation in core

services other than housing."

| The Future -- The May Exam! |

| Steven M. Reff Economics Lecturer University of Arizona (2007 - 2016) The 2015 University of Arizona Five-Star Faculty Award |

January 2007

May 2013

Inside the AP® Macroeconomics Classroom CED, Topic 4.6 Monetary Policy, the term "policy rate"

is used just 2 times.

*Many central banks carry out policy to hit a target range for an overnight interbank lending rate,

sometimes referred to as the central bank’s policy rate. (In the United States, this is the federal funds rate.)

*the other time policy rate is used is on the y axis label of The Reserve Market Graph below to the left.

(I created an interactive graph of this next to it where you can move S and D and draw on the graph

with your finger, cursor, or a computer pen.)

is used just 2 times.

*Many central banks carry out policy to hit a target range for an overnight interbank lending rate,

sometimes referred to as the central bank’s policy rate. (In the United States, this is the federal funds rate.)

*the other time policy rate is used is on the y axis label of The Reserve Market Graph below to the left.

(I created an interactive graph of this next to it where you can move S and D and draw on the graph

with your finger, cursor, or a computer pen.)

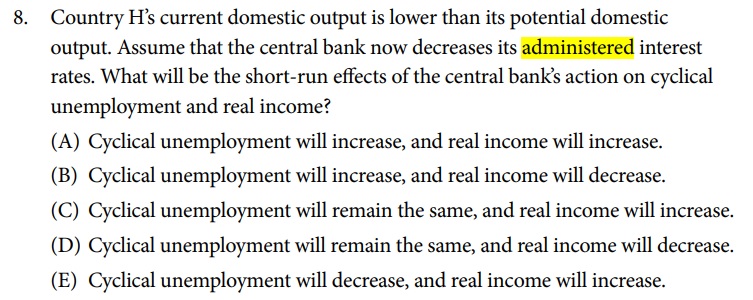

ALSO:

Inside the AP® Macroeconomics Classroom CED, the term "interest on reserves" is used just 2 times.

*(The banking system in the United States has ample reserves, and the Federal Reserve’s key policy tool is interest on reserves.)

*the other time interest on reserves is used is in the multiple choice question with a graph shown below.

The interactive graph I created to the right of the multiple choice question shows what happens with monetary

policy related to the multiple choice question to BOTH interest on reserves and the policy rate (Federal Funds Rate).

The FOMC determines the effective FFR (the policy rate) and the Board of Governors sets the interest on reserves (IOR)

to move the target in the desired direction.

In the multiple choice question below, the economy is experiencing an inflationary gap. The FOMC sets the upper and lower target

for the FFR. The FRB takes these notes from the FOMC and sets the three administered rates:

1) Interest paid on Reserves (IOR) which is the primary tool of monetary policy

2) Primary Credit Rate, formerly known as the Discount Rate

3) Interest paid on Overnight Reverse Repurchase Agreements among Primary Dealers

raise the policy rate (targeted FED funds rate) and the Board of Governors would raise the interest on reserves to accomplish

this. As short term rates rise (FFR), this increases long-term rates, which decreases C and I, which decreases AD, and thus

decreases the PL.

Inside the AP® Macroeconomics Classroom CED, the term "interest on reserves" is used just 2 times.

*(The banking system in the United States has ample reserves, and the Federal Reserve’s key policy tool is interest on reserves.)

*the other time interest on reserves is used is in the multiple choice question with a graph shown below.

The interactive graph I created to the right of the multiple choice question shows what happens with monetary

policy related to the multiple choice question to BOTH interest on reserves and the policy rate (Federal Funds Rate).

The FOMC determines the effective FFR (the policy rate) and the Board of Governors sets the interest on reserves (IOR)

to move the target in the desired direction.

In the multiple choice question below, the economy is experiencing an inflationary gap. The FOMC sets the upper and lower target

for the FFR. The FRB takes these notes from the FOMC and sets the three administered rates:

1) Interest paid on Reserves (IOR) which is the primary tool of monetary policy

2) Primary Credit Rate, formerly known as the Discount Rate

3) Interest paid on Overnight Reverse Repurchase Agreements among Primary Dealers

raise the policy rate (targeted FED funds rate) and the Board of Governors would raise the interest on reserves to accomplish

this. As short term rates rise (FFR), this increases long-term rates, which decreases C and I, which decreases AD, and thus

decreases the PL.

With the above being said though . . .

Inside the AP® Macroeconomics Classroom CED, the term "administered rates" is used 5 times.

The tools of monetary policy may include the central bank’s discount rate and other administered interest rates (e.g., interest on

reserves), open market operations, and the required reserve ratio. The tools used and the way in which they are implemented differ

between economies that have limited reserves in their banking system and economies that have ample reserves in their banking

system.

The administered interest rates are:

*Primary Credit Rate (that used to be called the Discount Rate up until January 8, 2003). This rate is set by the Board of Governors

a certain number of basis points above the Federal Funds Rate. So as the FED funds rate rises, the PCR rises at the same time.

*Interest on Reserve Balances (IORB) or IOR. As IOR rises, the FED funds rate rises, and the PCR rises.

*Interest on Overnight Reverse Repurchase Agreement (ON RRP) -- Students don't have to know this or anything about arbitrage.

The policy rate is the:

*Federal Funds Rate

Inside the AP® Macroeconomics Classroom CED, the term "administered rates" is used 5 times.

The tools of monetary policy may include the central bank’s discount rate and other administered interest rates (e.g., interest on

reserves), open market operations, and the required reserve ratio. The tools used and the way in which they are implemented differ

between economies that have limited reserves in their banking system and economies that have ample reserves in their banking

system.

The administered interest rates are:

*Primary Credit Rate (that used to be called the Discount Rate up until January 8, 2003). This rate is set by the Board of Governors

a certain number of basis points above the Federal Funds Rate. So as the FED funds rate rises, the PCR rises at the same time.

*Interest on Reserve Balances (IORB) or IOR. As IOR rises, the FED funds rate rises, and the PCR rises.

*Interest on Overnight Reverse Repurchase Agreement (ON RRP) -- Students don't have to know this or anything about arbitrage.

The policy rate is the:

*Federal Funds Rate

| Forward Guidance: What is on the May Exam according to the CED? |

In the multiple choice question above Country H is

experiencing an output gap (lower than its potential

domestic output). If the FED decreases its administered

interest rates (IOR) which lowers the FFR (policy rate), this

will lower long-term rates which increase C and I which

increases AD which decreases cyclical unemployment, and

increases RGDP and real Y.

The correct answer is E.

experiencing an output gap (lower than its potential

domestic output). If the FED decreases its administered

interest rates (IOR) which lowers the FFR (policy rate), this

will lower long-term rates which increase C and I which

increases AD which decreases cyclical unemployment, and

increases RGDP and real Y.

The correct answer is E.

AP® is a trademark registered and owned by The College Board®, which is not affiliated

with, and does not endorse, this website, reffonomics.com, Joel Miller, Matt Pedlow,

Steven Reff, or FEE.org.

with, and does not endorse, this website, reffonomics.com, Joel Miller, Matt Pedlow,

Steven Reff, or FEE.org.

The below Enduring Understanding, Learning Objectives, and Essential Knowledge are from

the AP® Macroeconomics Course and Exam Description, Effective Fall 2020

(collegeboard.org).

*AP® and Advanced Placement are registered trademarks of The College Board® which is

not affiliated with online.reffonomics.com, FEE.org, nor does it endorse this Principles of

Macroeconomics Course Curriculum.

the AP® Macroeconomics Course and Exam Description, Effective Fall 2020

(collegeboard.org).

*AP® and Advanced Placement are registered trademarks of The College Board® which is

not affiliated with online.reffonomics.com, FEE.org, nor does it endorse this Principles of

Macroeconomics Course Curriculum.

| Click on this link for The History of Ample Reserves Regime: |